15:54, 8 June 2021

5087 views

5087 views

“Banks and retail. Digital transformation and interaction”. The first summary of the PLUS-Forum held in the capital of Uzbekistan

The first international PLUS-Forum: “Banks and retail. Digital Transformation and Interaction” took place in Tashkent on June 1, 2021.

The Republic of Uzbekistan, the pearl of the Central Asia, is currently one of the most dynamically developing partners of Russia, open both for international cooperation and new investments, and for innovative technologies. It is no coincidence that the SCO summit will be held there in 2022 to determine the key lines of development of the global economies in the coming years. For the same reason, PLUS Media Holding chose Tashkent, the capital of the Republic of Uzbekistan, as the venue for the First International PLUS-Forum: “Banks and retail. Digital transformation and interaction”.

On June 1, the fashionable Hyatt Regency Tashkent hotel became a geo-point that brought together leading experts and top managers of the banking and payment industry, large retail chains, wholesale, consulting and telecommunications companies, research agencies, IT and insurance firms, logistics companies, as well as other specialized organizations from different countries interested in the implementation of current initiatives, joint projects and in the development of cooperation with partners in Uzbekistan.

The strategic goal of the event is to give a boost to the development of the economy of Uzbekistan, to the promotion of Russian-Uzbek and international cooperation in the field of banking and financial technologies, development of new promising projects, including international ones.

The “Banks and Retail. Digital Transformation and Interaction” Forum became an effective open platform for productive business communication between the regulator, banking structures, fintech and large retailers in order to discuss the most pressing business issues.

The event was attended by more than 30 key speakers and over 700 top managers and experts in the field of banking, fintech and retail. Leading experts in the banking and payments industry, telecommunications, research and consulting companies, the banking community of the Eurasian continent (banks and microfinance organizations of Uzbekistan, the CIS and the EAEU), as well as technology and manufacturing companies discussed the development of the national payment system, the prospects for central bank digital currencies (CBDC), transformation of the retail sector, cyber resilience in banking and many other edgy topics.

Ilkhomjon Abdugafarov, Deputy Governor of the Central Bank, Member of the Board of the Central Bank of the Republic of Uzbekistan, opened the Forum with a welcoming address. He has noted that Uzbekistan is cooperating with the Bank of Russia and planning to adopt the successful experience of the later in the field of payment systems oversight: “The regulators of the two countries are working on signing a memorandum of understanding in the field of oversight and monitoring of the payment systems and payment services market players”. This document will define the procedure for interaction and data exchange between the parties insofar it concerns the development of the payment systems.

In 2020, the law “On payments and payment systems” came into force in Uzbekistan. The adoption of this law should facilitate uninterrupted payments and large-scale introduction of innovative technologies, as well as the efficient, robust and secure performance of the payment systems of Uzbekistan. “Following the policy of market openness and building a level playing field, the Central Bank supports local startups and seeks sources of finance and organizational facilities from abroad to accelerate digitalization in Uzbekistan,” Mr. Abdugafarov stressed in his speech.

The Forum allowed banking institutions, fintech companies and retailers to discuss the most pressing market issues. The experts stated that the rapid development of digital technologies had been a key driver of almost any business in recent years. The corona crisis year of 2020 forced the banking community and the financial industry as a whole, to look differently at the mass services segment and the operation of payment systems. The digital “reset” of the banking and financial institutions required a restructuring of all business processes, as well as a change in the core beliefs of the market participants themselves. This has become the dominant of the speeches and discussions at the PLUS-Forum. The experts focused on important issues of introducing new technologies, automation and robotization of services.

Shukhrat Faizullaev, Deputy Director of the Payment Systems Department of the Central Bank of the Republic of Uzbekistan, drew the delegates' attention to the goal-oriented and systemic development of banking and financial legislation in the country. In the near future, the law “On payments and payment systems” will be enhanced with by-laws aimed at further development of the digital banking and financial market in Uzbekistan.

Sh. Faizullaev has noted that five operators of electronic money systems are included in the register of the Central Bank now. Two digital banks, ANORBANK and TBC Bank Uzbekistan, JOYDA and Uzpromstroybank marketplaces and global IT platforms created by Aloqabank, operate in Uzbekistan today.

One of the most innovative banks in the republic, Orient Finance, was the first in Uzbekistan to start servicing Mastercard cards. In 2020 it became a pioneer of the Uzbek market starting to restructure its business with a focus on the development of remote customer service channels.

Sherzod Tuiboyev, Deputy Board Chairman, Orient Finans Bank (OFB), spoke about the most promising innovations of this financial institution, including the OFB-Express online payment platform: “This is a fundamentally new payment solution that allows payments to be accepted on any sites where commercial activities are carried out. We have made running business easier for our clients, created a convenient service that supports cashbacks, refunds and purchase returns for transactions through an electronic wallet. We also improved the functionality to allow placing orders and purchasing from several stores at the same time. We developed special rating calculation algorithms aimed to set individual cashbacks.”

The thought shower during business communication, huge interest of business in new points of growth driven by the digitalization of both products and channels of communication with customers, became an objective evidence of the high level of the First International PLUS-Forum: “Banks and retail. Digital transformation and interaction”, which is undoubtedly set to expand its international borders much more.

Among the key speakers:

• Ilkhomjon Abdugafarov, Deputy Governor of the Central Bank, Member of the Board of the Central Bank of the Republic of Uzbekistan

• Shukhrat Faizullaev, Deputy Director of the Payment Systems Department of the Central Bank of the Republic of Uzbekistan

• Viktor Dostov, Chairman, Association of eMoney and Remittance Market Participants (AED); Chief Research Officer at Saint Petersburg University

• Alexey Maslov, Co-Chairman of the Payment Systems Committee of the Association of Banks of Russia

• Rafal Trepka, General Director, Mastercard Central Asia

• Farrukh Ziyaev, General Director, UZCARD payment system

• Shukhratbek Kurbanov, Director, HUMO payment system * на сайте позиция указана как Director, National Interbank Processing Centre HUMO. Прим.пер.

• Roman Sayfulin, Managing Director, MAKRO supermarket chain

• Mikhail Shashilov, head of cross-border payments CIS, Tinkoff

• Lilia Vladykina, Analyst, Euromonitor International

• Ulugbek Tavakkalov, Deputy Board Chairman, Tenge Bank * на сайте: PromStroyBank of Uzbekistan. Прим. Пер.

• Sherzod Tuiboyev, Deputy Board Chairman, OrientFinansBank

• Sergey Gimadiev, Deputy Board Chairman, Manager of Digital Branch, Kapitalbank

• Vitaly Kopysov, Head of Innovations, SKB-Bank Group

• Farrukh Makhkamov, Deputy Board Chairman, Alokabank

• Herman Stimban, Head of data base and information systems development, Project Managament Center of e-government under the Ministry for Information Technology and Communications Development of the Republic Uzbekistan

• Roman Sayfulin, Managing Director of a supermarket chain, MAKRO

• Jamshid Rakhimberdiev, CEO, IDEA CONCEPT GROUP

• Rinat Kunafin, retail chain director, GOODZONE home appliances store

• Malik Karimov, Marketing Director, Korzinka.uz supermarket chain

• Zhasur Khasanov, Deputy Board Chairman, Hamkorbank

• Akmal Makhmudov, Director of Retail Business Department, Hamkorbank

• Naima Mirzaeva, Director of Retail Business Department, Kapitalbank

• Abdulaziz Sattarov, Board Member, Universalbank

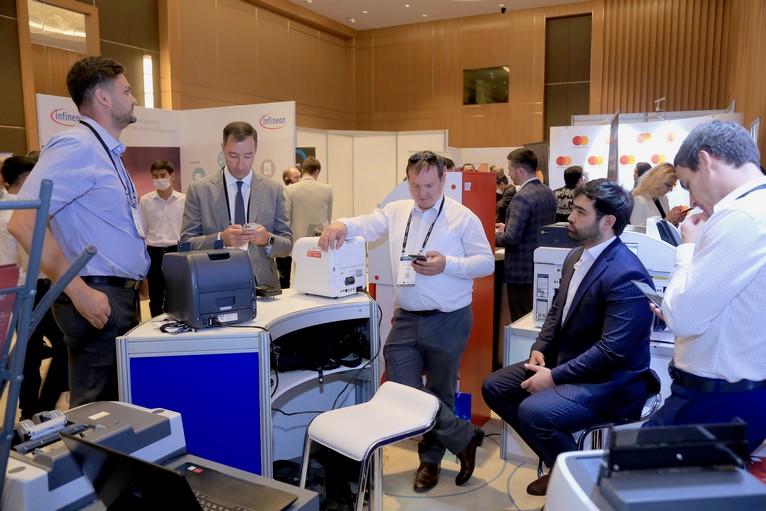

Products from the world's leading technology companies, equipment vendors and solution and service providers were presented in the large-scale exhibition area of the PLUS-Forum.

Of special note is the fact that the PLUS-Forum “Banks and Retail. Digital transformation and interaction” was held under the official patronage of the Central Bank of the Republic of Uzbekistan, the Embassy of the Republic of Uzbekistan in the Russian Federation, and the Trade Delegation of the Russian Federation in the Republic of Uzbekistan.

Our special thanks to sponsors and partners who extended their support to the Forum! See you at the next PLUS-Forums!

Sponsors of the PLUS-Forum “Banks and Retail. Digital transformation and interaction”:

Cocktail sponsor: Mastercard

Platinum sponsors: BS/2, Thales, Fido Biznes, Uzcard

Gold sponsors: Osnova, Infineon, Infobip, BPC, Oz Forensics, tietoEVRY, nadeks, Navin, SmartCard Service, Edna, SoftClub, Vision Lab, Banza

Silver sponsors: TSS, PayMo

Bronze sponsors: Compass Plus, QIWI, OSTKARD, ATM Alliance, R-Style Softlab, ELQ Uzbekistan, GRG Banking, Service Model, Compliance Control, KM Alliance, DIS Group

Registration sponsor: NCR

Partners: Dr.Web, KPMG, OCTO

Technical partner: Uzbektelecom

Forum media partners: Association of Banks of Uzbekistan, ICT2Go, Jobsora, Vybery, NBJ, HH, Bankers.uz, Deposit.uz, Union of Banks of Kyrgyzstan, Association of Belarusian Banks, JBA, SBK, KURSIV, Association of Banks of Armenia, Association of Banks of Azerbaijan, BrightUzbekistan

Read more: https://uz.plus-forum.com/

The next edition of the PLUS-Forum “BANKS AND RETAIL. Digital Transformation and Interaction” will take place in Tashkent in 2022.

We will keep you informed on an on-going basis.