Uzbekistan Market. Key Trends and Events 2024 – early 2025

In recent years, Uzbekistan has been developing rapidly, demonstrating not only impressive economic growth, but also the fast implementation of technological innovations. It is no coincidence that Tashkent is preparing to host - for the fifth time - the International PLUS-Forum Digital Uzbekistan, one of the largest events in Central Asia. The event supported by the National Agency for Perspective Projects of the Republic of Uzbekistan will be held on May 28-29, 2025.

In Uzbekistan, like everywhere in the world, digital technologies remain the most popular line of business of local startups. Among the successful examples of startups generating significant income are Zood, ArzonApteka, Didox, Alif and others. The state supports innovative entrepreneurship through implementation of a series of initiatives such as the IT Park, zero taxes, a system of state financing for successful projects, and numerous acceleration programs.

The findings of a recent study by INFOLine show that commercial firms are highly interested in developing business in Uzbekistan, with the main focus made on the expansion of existing lines of business.

Thus, 85% of companies operating in the Republic of Uzbekistan are planning to scale up their business. This figure demonstrates the high level of local players’ confidence in the sustainable growth of the economy of the Republic of Uzbekistan. At the same time, about 30% of surveyed foreign companies are interested in developing their business in Uzbekistan.

The study also showed that, despite the overall positive mood, mere 5% of companies are planning to launch a new business in the republic from scratch. This may be explained by the need for a more in-depth risk assessment or a scarcity of resources required for entering the market. High risks, regulatory complexities or lack of information are holding back the development of about 5% of companies that are not yet ready to actively operate in the market.

“Uzbekistan has several important advantages for international businesses,” INFOLine founder Ivan Fedyakov believes. “First, a growing market with its growth driven by a number of factors. If we compare the demographic indicators of Uzbekistan and Russia, we will see that in the Russian Federation where the population amounts to 146 million people, 1.2 million babies were born in 2024, while in Uzbekistan, with almost four times smaller population, 0.9 million babies were born – slightly less than in Russia and 2.5 times more than in Kazakhstan. The natural increase in the Republic of Uzbekistan amounted to 743 thousand people, while in Russia the population drop exceeded half a million.”

A serious role is also played by the demographic characteristic such as the age of the population. According to Nielsen Kazakhstan, the population structure of Uzbekistan facilitates the development of the market:

- 70% of the country's residents are under 39 years old

- the average age is 28.5 years

- high birth rate and the share of large households form stable demand.

The young population embraces online shopping, prefers personalized offers and serves as the driver of the digital commerce growth. Young people are better financially literate, interested in the most innovative product offers from banks and fintech, show interest in the crypto industry and digital financial assets, and better protected from various types of fraud, including social (criminal) engineering.

The growth of incomes and intensive urbanization of the population are also important for the prospective development of business in the country.

Regarding the consumer market, with the retail turnover growth in comparable prices (unadjusted for inflation) by 9.9% in 2024, Uzbekistan overtook Kazakhstan, Russia and Belarus, but lost to Kyrgyzstan, according to INFOLine. In 2023, Uzbekistan saw the retail turnover dynamics of 9.1%.

Digital Uzbekistan 2025: what is worth attention?

The International PLUS-Forum Digital Uzbekistan is traditionally aimed at high-quality and effective networking, finding partners and clients, as well as at communication between top managers and specialists from a wide range of spheres and industries in Central Asia. One of the strategic objectives of the PLUS-Forum is to give additional impetus to the development of the economy of Uzbekistan, international cooperation in the digitalization of the country, banking and retail sectors, and to the development of fintech.

The Forum program includes the widest range of issues, including the Digital Som project, improvement of GovTech, artificial intelligence platforms in public administration, business and everyday life of society, the present and future of the cryptocurrency industry, further development of eCommerce and many more.

A special focus will be given to the topics such as Women in Tech, BNPL and digital car sales, which, for the first time ever, will be discussed at dedicated sessions.

No less attention will be paid to the development of modern banking in Central Asia and other regions, including Islamic finance and Islamic banking, as well as the crypto industry and its regulation.

This year, the heads of relevant regulators and other government agencies of the Republic of Uzbekistan directly responsible for digitalization processes in the country will speak at the PLUS Forum. Among them: the Central Bank of the Republic of Uzbekistan, the National Agency for Perspective Projects of the Republic of Uzbekistan, the Ministry of Digital Technologies of the Republic of Uzbekistan and others.

Also, the event will be attended by top managers of the major commercial banks and the country’s mobile operator, including: Kapitalbank, APEX BANK, Hayot Bank, Orient Finance Bank, Octobank, Untitled Bank, Alif Uzbekistan and others.

The presence at the PLUS-Forum of commercial entities such as the largest marketplaces, exchanges, crypto exchanges and associations will be no less wide to include Mastercard, WeChat, Wildberries, M.Video-Eldorado, Eeeng ЯQН.

At the large-scale exhibition, over 70 exhibitors from 35 countries will demonstrate their latest innovations and share specific business cases of their application.

This year again, we have managed to form a truly unique line-up of speakers!

Among them:

• Sodir Melibaev, Deputy Chairman and Board Member of the Central Bank of the Republic of Uzbekistan

• Denis Filippov, General Manager, Mastercard Uzbekistan

• Ulugbek Tavakkalov, Deputy Board Chairman, KAPITALBANK

• Sami Zafar, Director, Edgar, Dunn & Company

• Baran Aytash, Advisor, Ex-CEO, Interbank Card Center (BKM) and Troy

• Bakhrom Numonov, Board Chairman, APEX BANK; Council Chairman, Association of Islamic Finance and Takaful

• Dmitry Peshnev Podolskiy, CEO, DPP Partners, formerly Home Credit Bank Board Chairman

• and many other internationally and regionally recognized experts

Let us reveal the main reason why, in our opinion, such interesting people traditionally attend our event. The most important thing is that our company is a consulting firm operating in the market since 1993. As a result, our brand has unique competencies. Besides, we do treat the representatives and experts of relevant ministries and departments with respect, since they have another remarkable quality for which we value them - the views and opinions of each of them carry a vector to the digital future that awaits us and where we are all heading for!

Trends in fintech

Amidst a rapidly changing global political and economic situation, fintech in Uzbekistan goes ahead in its development.

In general, we can highlight several trends that were the main ones in 2024 for Uzbekistan.

BNPL services seamlessly integrated into purchases. The services are already widely adopted by the market.

Fintech in MFOs. Recently, a law on microfinance organizations was adopted in Uzbekistan aimed at “Increasing the role and share of microfinance services in the development of entrepreneurial activity”. The law qualifies MFOs for entering into leasing agreements, providing guarantees and factoring services – putting money on accounts with repayment in installments. Besides, microfinance lenders can provide services related to Islamic financing in compliance with the procedures established by the Central Bank based on the standards outlined by international organizations. By virtue of such changes, we predict the launch of independent super apps (Lending Apps) for issuing microloans, and those “embedded” in marketplaces. With consumers feeling already more comfortable and sure-footed in the online shopping segment, a surge in the adoption of many apps and services is expected. Such apps and services will allow customers to enjoy a user-friendly interface and various “custom features” for their use and monitoring of expenses and bonuses, such as Embedded Finance.

Also, new installment business models such as SNPL (Save Now Buy Later) will also emerge. This new fintech business model offers a more sustainable alternative to the BNPL (Buy Now Pay Later) model in the face of rapidly changing consumer demand and purchasing behavior. SNPL allows customers to save money on a monthly basis to accumulate a required amount for a specific purchase. This trend has already become relevant for Uzbekistan in late 2024.

Cross-border and local payments. In 2024, payment companies kept improving their mobile wallets and the Payments Gateway service.

Alphacon CEO & Founder Otabek Kurbanov notes that “the launch of new interesting card products from Payme, Uzum Bank, Ipak Yuli Bank with an interest-free period for the cardholder can undoubtedly be called the main trend of recent months. Also, though it may sound a little immodest, it is the forthcoming launch of the first offline-online B2B marketplace of services developed by our company, which helps entrepreneurs save a lot of time when enabling financial and other services from providers on the market.”

Investment platforms. Since the capital market also joined the NAPP, 2024 saw an increasing number of projects and the entry of new players into the market in order to create investment platforms.

InsurTech. A pioneer startup has appeared in the republic, which offers marketplaces for all insurance players and a quick form completion through a mobile application. The population of Uzbekistan is growing, the number of cars owned by citizens is increasing, and accordingly, the insurance culture is scaling. According to the National Agency for Perspective Projects (NAPP), about 10 million insurance contracts were concluded in Uzbekistan in 2024, and the insurance premiums reached 9.8 trillion soms (+ 21% compared to 2023). Insurance benefits grew by 9%, amounting to 2.2 trillion soms, and the total assets of insurers increased by 24.9%, to reach 11.8 trillion soms.

Artificial intelligence. Using AI to improve forecasts, create models and develop analytics, including the active use of ChatGPT in e-commerce, is another trend. Most likely, AI will be widely used in bank offices, as well as in risk management, especially in the analysis of credit, market, currency risks, as well as in macro- and microeconomic analysis. Customer support will also be rapidly developed to use chatbots in applications and voice assistants. And, of course, AI platforms will be used in the antifraud activities.

Artificial intelligence is penetrating various spheres of life, implementing the technologies of the future into reality. In Uzbekistan, the Unified Integrator UZINFOCOM plays a key role in this process. The company implements advanced AI-based projects, such as biometric identification and voice assistants, adapting them to local needs. We talked with Rustam Alavutdinov, Head of AI Department, to discuss how UZINFOCOM is implementing these innovations through partnership with world leaders such as iFLYTEK and BYD, and how these innovations contribute to the technological development of Uzbekistan.

Rustam Alavutdinov noted: “We at UZINFOCOM are developing several projects, including the MyID biometric identification system for remote identification of clients in the banking and financial sectors, public services and e-commerce. MyID allow users to access services remotely, which significantly simplifies the interaction with various institutions. With the digitalization of all services delivered by the providers, this technology guarantees accurate and convenient identification of citizens. Today, our service is used in more than 150 projects, including 28 banks, 16 payment systems, etc., while the number of successful identifications has exceeded 60 million. The number of users is expected to exceed 12 million by the end of the year.

We are also working on the Muxlisa AI, a voice assistant system capable of converting speech to text (STT) and text to speech (TTS) in the Uzbek language. Based on this technology, we have already launched a chatbot with natural language processing and understanding (NLP, NLU) functions. This allows us to significantly improve interaction with users in the Uzbek language and automate many processes.

iFLYTEK is our key partner and exclusive supplier of AI solutions for BYD. At the end of 2023, we developed and delivered voice control software for cars in the Uzbek language, which works through the Internet connection. After that, iFLYTEK approached us with a request to create similar software, but without the need for an Internet connection. It took the team more than six months of hard work to solve this task. We are currently adding minor enhancements and look forward to our software being used in BYD cars.

Speech analytics. Some banks in Uzbekistan have already begun to implement speech assistants in customer relations.

Big Data. The technological future of business has already arrived, and companies that have realized the importance of Big Data and AI are moving ahead in the race for a competitive advantage. The first and major player in monetizing Big Data in Uzbekistan was the Digital Government (DG). It sells now over 100 types of useful data for scoring and for clients to banks and fintechs. Sales of Big Data by telecom operators and payment organizations are gaining momentum.

Development of new regulatory technologies (RegTech). This is necessary for deeper monitoring and control of transactions.

Security

Implementation of cyber defense. Since 2023, cyber security in Uzbekistan has become an element of recognized necessity, rather than just a trend. For example, in September 2023, the first cyber defense exercises Cyberkent 2023 were held at the Cyber Security Center. Also, the Central Asian Cyber Security Summit CSS 2023 was held in Tashkent, where two teams competed. “White hat” and “black hat” hackers arranged precedents involving the system vulnerability and also attacked the system.

Head of the Security Operation Center (SOC) PS Cloud Services Alexander Pushkin comments on the current situation: “In the modern world, where cyber threats are getting increasingly sophisticated and destructive, the role of security programs is becoming important. Today, every company, be it a large corporation or a small business, needs a competent entity responsible for information protection. That’s exactly why strategies are developed to protect the organization’s critical data and assets from cyber attacks. Yet, there is one thing to be kept in mind: this entire model will not operate effectively unless you manage to find a highly competent information security entity and sign an agreement under which the outsourcer will perform at its best.”

Anti-fraud management. This issue is especially relevant when monitoring fraud and when working with consumer payment cards, primarily in the context of poor financial literacy of the population

In November 2024, the National Bank of Uzbekistan officially warned the citizens about a new type of bank account fraud, where criminals notify the victims of their account hacking and urge them to “update the single registration bank number”. Pseudo-bankers, under the pretext of protecting a bank account, install malware and gain access to all client accounts.

Centralization of the anti-fraud efforts and tougher information security requirements stem from the new standards introduced by the Regulation of the Central Bank of the Republic of Uzbekistan.

As noted by Pavel Lee, auditor-consultant at QSA Compliance Control, “New Regulation No. 3513 of the Central Bank of the Republic of Uzbekistan has strengthened the regulation of the fintech industry in Uzbekistan, establishing stricter requirements for cybersecurity, payment data protection and combating fraud. Fintech companies are forced to implement two-factor authentication, tighten access control and ensure compliance with international security standards. The requirements for regular audits and interaction with the regulator have been tightened, which has improved the transparency and increased responsibility of market participants. As a result, user protection measures have been strengthened, the risks of fraud have been reduced, and the confidence in digital financial services has grown.”

Information security. The state takes special measures to support and regulate the information security of the banking sector in Uzbekistan.

Artem Saidov, Head of Information Security at HAYOT BANK, discusses this in more detail: “The issues of information security, as well as anti-fraud, are permanent agenda items of the top public officials. Representatives of the presidential administration and other government bodies are increasingly frequent attendees of meetings at the Central Bank. The Central Bank of the Republic of Uzbekistan, as the main regulator, is tightening the cybersecurity and anti-fraud requirements. For example, in August 2024, Regulation No. 3513 of the Central Bank of the Republic of Uzbekistan came into force.

We can also highlight the requirement for round-the-clock operation of the SOC and anti-fraud service, which is quite difficult for small organizations to fulfill.

Regarding the main information security challenges that companies face in Uzbekistan, the key problem is the extremely limited number of qualified personnel. Experienced specialists do not always have sufficient skills, but at the same time they have high salary expectations.”

QR code Payments

The history of QR codes in Uzbekistan differs significantly from the global trend. In particular, in many countries around the world, using QR codes and E-POS systems for payments is double or triple cheaper than traditional methods. However, in Uzbekistan, on the contrary, such payments cost merchants on average five times more, while the current average market rate is about one percent.

The cost of paper and dynamic QR codes shows that paper QR codes may seem less expensive, especially if you consider only the cost of the sticker, which averages 16 thousand soms. Meanwhile, there is also a team engaged in the sale of these stickers, partner support and analytics, which adds to the costs.

The implementation of a single QR code is complicated by the fact that most partners are small companies, accounting for about 60% of the market. These companies can achieve significant transaction volumes, sometimes up to two billion, which requires a temporary shutdown of the system to switch to a new QR version. If the analyst or team fail to notice the need for an update, this can lead to the payments redirection errors, causing customers’ and partners’ dissatisfaction.

Besides, the uniqueness of each company is important for building a loyalty system with partners, which helps to attract a new audience. QR codes offer a value that varies by different business categories such as restaurants, gas stations, or women's clothing stores. The approaches and methods of sales differ in each category, which makes the integration of a single QR code a labor-intensive process.

Nevertheless, QR codes open up new opportunities for business development, allowing companies to create personalized loyalty programs and improve customer relations. Each industry can benefit from this technology in its own unique way: restaurants, gas stations, and women's clothing stores can offer something special to their customers.

However, the problems that arose during the initial period of QR code implementation are often associated not so much with the technology itself, but with its incorrect use by merchants. Incidents where payments are incorrectly registered or redirected cause customer dissatisfaction and can undermine confidence in the system.

Successful development of QR codes in Uzbekistan requires intensive cooperation between businesses and regulators, as well as the adaptation of legislation and tax policy. A properly configured system can significantly simplify payment processes and make them easier to access and readily available for all market participants.

Crypto industry

In the era of digital innovation and growing interest in cryptocurrencies, Uzbekistan, being forward-thinking, actively develops and regulates the crypto asset sector.

In terms of crypto asset adoption, Uzbekistan ranks 1st in Central Asia and the Caucasus and 33rd in the world.

As of 2023, over half a million (512,322) people in the republic own crypto assets, which is 1.46% of the total population.

The licensed providers’ turnover in Uzbekistan exceeds $1 billion, and state budget revenues from the crypto industry have exceeded $3.6 million since 2022. The number of crypto service providers in Uzbekistan keeps growing to reach 15 entities as of October 2024.

Since the powers of the National Agency for Perspective Projects of the Republic of Uzbekistan (NAPP) have broaden significantly, the implementation of blockchain technologies was more active in 2024. Since NAPP is now empowered to regulate payment service providers, this opens up opportunities for the emergence of embedded crypto exchange services in wallets (on-ramp/ off-ramp services).

According to NAPP, in 2024 crypto asset service providers paid to the state budget 2.38 billion soms in state duties and 8 billion soms in activity charges. Total revenues for the period from 2019 reached 56.5 billion soms, which proves the stable growth of the sector.

These figures are largely determined by the fact that Uzbekistan has created a comprehensive regulatory framework during the period starting from 2018. It covers licensing and activities of service providers, AML, tokenization, mining and circulation of crypto assets. Such a regulatory framework forms clear working conditions for service providers and crypto asset owners, due to which Uzbekistan ranks 1st in terms of crypto asset adoption in Central Asia.

The crypto asset turnover laws of the Republic of Uzbekistan define the main terms and definitions in this area. According to that, the term “crypto asset”, not “cryptocurrency”, is used in the Republic of Uzbekistan. This is primarily due to the fact that “crypto” is defined as “assets” instead of a currency or other payment means or instrument.

In January 2025, the Binance crypto exchange was launched in Uzbekistan owing to the assistance of the National Agency for Perspective Projects (NAPP) and cooperation between CoinPay and Binance, in compliance with the legislation of Uzbekistan.

Vladimir Gorgadze, Head of the blockchain department at the Moscow Institute of Physics and Technology (MIPT) (the base organization is the Idea research center), Co-Founder of the Newity IT company, comments on the Development of blockchain technologies and cryptocurrency initiatives in Uzbekistan: “Since 2022, Uzbekistan has become one of the most important hubs for the development of blockchain and crypto projects in Asia. The accelerated development of crypto initiatives has become possible due to the adoption of key legal and regulatory acts, as well as the energetic work of regulators with the market. From 2022 to 2025, 16 licenses were issued for market entities providing virtual asset services.

In May 2022, a law was passed allowing solar energy-powered crypto mining by legal entities registered with the National Agency for Perspective Projects (NAPP). A “regulatory sandbox” to regulate the crypto assets turnover was also established and then joined by Kapitalbank, Ravnak-bank and UZINFOCOM. As part of the initiative, banks are developing cryptocurrency cards. Kapitalbank, together with the UzNEX exchange, issued the country's pioneer cryptocurrency card, and UZINFOCOM introduced a NFT certificates system for domain names.

In 2024, the Heemera project designed to recover stolen digital assets, and the Token.uz service operating on the Ethereum and Arbitrum networks for secure data storage, were launched. Also in March 2024, Tether and the NAPP signed a memorandum of cooperation in the field of blockchain and digital currencies, and Binance announced its intention to resume operations in Uzbekistan through the licensed company CoinPay

In 2024, a series of international forums were organized with the agenda containing the topic of blockchain development: Crypto Week Uzbekistan (June 3–5, 2024), PLUS-Forum “Digital Uzbekistan” (June 12–13, 2024), Fintech & Banking (October 3–4, 2024).

Further editions of these forums in May–June 2025 have already been announced, and “Fintech & Crypto Week 2025” is also expected to be held in April 2025. These and similar events serve as the basis for the growth of the industry as a whole. For our part, we see a growing number of requests from the republic’s businesses and government bodies to improve the level of education in the blockchain industry.

The basic set of regulatory documents was adopted by the regulator back in 2022. Among them were orders of the head of NAPP No. 3379 “On approval of the Rules for cryptoassets trading on the cryptoexchange”, No. 32 “Regulations on the procedure for licensing the service providers’ activities in the field of cryptoassets turnover”, No. 3388 “On approval of the Regulation on setting, payment and distribution of fee rates for dealing in cryptoassets”, as well as MU No. 3395 “Rules for crypto store operation", MU No. 3397 “Regulations on the procedure for cryptoassets issuing, registering and handling by residents of the Republic of Uzbekistan”, MU No. 3409 “Regulations on the registration procedure for participants in the Special regulatory regime in the sphere of cryptoassets turnover”. Last year, additional regulations were issued to strengthen the positions of crypto industry players (orders of the head of NAPP No. 3461 “On approval of the Regulations on the procedure for issuing permits for mining activities” and No. 3493 “On approval of the Regulations on providing a special legal regime, “regulatory sandbox”, in the capital market”).

Thus, the development of blockchain technologies and crypto projects in Uzbekistan is driven both by fairly extensive government initiatives and by the activities of crypto community deeply involved in business development and supporting international industry events and participating therein.”

Microloans

Micro loans and installment plans are fraught with significant credit and operational risks due to the poor financial literacy (loans are often issued by fraudsters to naive consumers), the possibility of bypassing scoring models (for example, falsely increased transaction activity on cards).

Banks, for their part, are evolving in their scoring models, honing their hypotheses. The development of scoring is a continuous evolutionary process. New positive trends include the use of data from telecom operators and payment organizations.

Banks, fintechs and retail will compete and strengthen their interaction. Bank microloans will increasingly evolve into partner installments; retailers' goods will increasingly be sold in marketplaces and delivered through pick-up points opened in the vacated premises of bank branches. Retailers will increasingly make payments through e-commerce tools organized by banks. Competing with fintechs and non-bank credit organizations, banks will develop card installments more energetically, since it is more flexible (renewable), and it allows an easy launch of an installment plan without being tied to merchants, where the remuneration is paid by the consumer through a fixed subscription fee (the consumer spends money wherever s/he wants and pays a fixed subscription fee regardless of his/her activity).

E-commerce

The development of e-commerce in Uzbekistan has recently been characterized by the expansion of marketplaces, including Russian ones, as well as the growth of the self-employed.

According to the National Agency for Perspective Projects (NAPP), the activities of the major international marketplaces, including Yandex, OZON, Wildberries and Wolt, have been localized in Uzbekistan in 2024. More than 10 global e-commerce platforms have opened their representative offices in the country, which resulted in the receipt of 160 billion soms in taxes and a 55% increase in the self-employed numbers.

On May 1, 2024, the Cabinet of Ministers of Uzbekistan approved a new antimonopoly regulation for the commodity and financial markets, which came into force on August 3. Zafar Vakhidov, partner of the Vakhidov & Partners law firm and Chairman of the Council of Antimonopoly Experts (Uzbekistan), comments: “With the adoption of this document, special antimonopoly regulation takes effect with respect to the activities of digital platforms. With the expansion of various digital platforms in Uzbekistan, including marketplaces (Uzum, Wildberries, OZON) and aggregators (OLX, Yandex, MyTaxi), the issue of regulation and control are getting more relevant in comparison with previous years.

The new rules are designed to increase competition between these platforms and reduce the risk of abuse by companies that dominate the market or have significant negotiating power. This, in turn, will help protect consumer rights and support fair competition. At the same time, any digital platform that holds a significant market share can be recognized as dominant under the new rules. To avoid violating antitrust laws, such companies are advised to regularly check their activities and agreements with partners for compliance with antitrust requirements. This will help them minimize risks and continue their operations within the bounds of the law.

According to Kamronbek Mukhammadiev, Head of E-Commerce Development and Regulation at the National Agency for Perspective Projects, the new rules give businesses the opportunity to get prepared, review processes and implement the necessary changes. The transition period was envisaged to help companies adapt to the new conditions. Foreign e-services providers in Uzbekistan are required to register with tax authorities and pay a 12% VAT. To date, more than 70 foreign companies already comply with these requirements.

At the same time, it was noted that the new rules were being developed in dialogue with businesses.

“We worked closely with e-commerce players to take into account their proposals and adjust the requirements where necessary. The agency seeks to create favorable conditions for business,” notes Kamronbek Mukhammadiev.

These changes are aimed at regulating the e-commerce market, ensuring equal competition between local and foreign players, and strengthening tax discipline in Uzbekistan.

At the same time, the National Agency for Perspective Projects and the Tax Committee of Uzbekistan announced restrictions to be imposed on the use of the TEMU electronic trading platform in the country from March 20, 2025.

During the inspection of the activities of foreign marketplaces, it was revealed that some foreign platforms did not comply with legal requirements in the field of electronic commerce, consumer protection, personal data and advertising. In view of that, a decision was made to put a restraint upon TEMU’s activity.

Chairman of the Association of Electronic Commerce of Uzbekistan Muzaffar Azamov comments on the situation: “This is a logical step in the context of protecting the domestic market. The inspections revealed that some foreign marketplaces, including TEMU, do not comply with national laws as regards tax payments, which creates an unfair playing field for local entrepreneurs. A regulation that came into force in Uzbekistan on December 27, 2024, obliges all e-commerce companies operating in the republic to be resident legal entities. This rule applies to all market participants, including local and foreign platforms. A transition period is envisaged for the adaptation of businesses to the new conditions: additional requirements will be effective from July 1, 2025.”

Speaking about a future model for regulating e-commerce in Uzbekistan, Muzaffar Azamov noted: “The main thing is to ensure a balance between protecting national interests and attracting international companies. If foreign marketplaces are ready to work under our laws, pay taxes and be responsible to consumers, they should be given this opportunity. That is the only way to form a healthy competitive environment that will be beneficial to both business and the state.”

Physical retail

The retail sector has experienced a continuous advent of global brands to the republic. Thus, an acquisition of the Baraka Market chain by International Beverages Tashkent was recently approved. The latter produces soft drinks under the Pepsi, 7UP, Mirinda, Mountain Dew, Adrenaline Rush and Lipton brands.

Some time ago, International Beverages Tashkent applied for the acquisition of a 100% equity stake in Urban Retail, the owner of the Baraka Market chain. Having analyzed the deal, the Competition Committee found it a corporate reorganization that does not violate the competitive environment.

Retail banking

With the significant slowdown of the som devaluation rate, 2024 brought some relief to the economy of Uzbekistan. According to the Central Bank of the Republic of Uzbekistan, the dollar exchange rate grew by as few as 4.71% (or 582 soms) over the year, much lower as compared to the figures of previous years. The average annual rate was slightly above the predicted one, but its growth was not as rapid as before.

For 2025, experts predict a moderate increase in the dollar exchange rate, which, according to average annual estimates, will amount to 13,250 soms. This is 4.8% higher than the expected level of 2024. Taking into account current economic trends, it is assumed that the dollar may exceed the mark of 13 thousand soms at the beginning of the year, and reach 13.7-13.8 thousand soms by its end.

According to the Central Bank of Uzbekistan, the volume of non-performing loans (NPL) in the banking sector reached 23.7 trillion soms as of February 1, 2025, to account for 4.5% of the total volume of issued loans.

In state-owned banks, the level of non-performing loans increased from 3.9% to 4.6%, and in private banks – from 4.1% to 4.3%. In absolute terms, the volume of NPL in state-owned banks amounted to 16.8 trillion soms.

According to the Center for Economic Research and Reforms (CERR), major banks in Uzbekistan such as Asia Alliance Bank, Ipak Yuli Bank, People's Bank, and Business Development Bank slightly worsened their positions in 2024. At the same time, experts noted that Octobank strengthened its position by record-breaking 3 points.

As of August 1, 2024, commercial banks issued 50.93 million bank cards, the National Bank of the Republic of Uzbekistan reports. In terms of the number of bank cards launched into circulation, the leaders are Narodny Bank (11.3 million cards), Agrobank (4.85 million cards) and Ipoteka Bank (4.36 million cards). International bank cards are issued to non-residents of Uzbekistan by Kapital Bank, Octobank, Asia Alliance Bank and other banks upon presentation of a personal identification number of an individual (PINFL), certificate of registration in Uzbekistan and SIM card from a local operator.

Denis Lakomov, an expert in financial technologies with experience in Russian companies, Director of Partnership Service at Hamkorbank, shares his vision of future transformations in the banking sector of Uzbekistan: “Today, the banking sector of Uzbekistan is undergoing transformation, with technology becoming the key driver of progress. Growing interest in fintech solutions places new demands on banks and opens up opportunities for the introduction of innovative products and services. Some banks are creating their own ecosystems, while others are choosing partnership as a development and transformation strategy.

The development of financial products and ecosystems in Uzbekistan has great potential, given the growing digitalization and the government's commitment to the improvement of financial inclusion. We are seeing the active implementation of innovative solutions and approaches, which opens up new opportunities for the creation of digital platforms and ecosystems offering a variety of services. For Uzbekistan, the development of such ecosystems means not only convenience for people, but also a stimulus for the economy. When financial services become available to everyone, it supports entrepreneurs, develops regions and creates new business opportunities. I am sure the future belongs to digital and integrated ecosystems. This is not a mere fashion trend, but also a real need of modern society, where people strive to promptly solve all issues in one place.

Taking into account modern realities, it can be noted that technologies such as artificial intelligence, instant payments and low-code platforms are the drivers of transformation of the financial sector. These tools not only increase productivity, but also make services more accessible, adapting them to the unique needs of each client.

Moreover, the emergence of digital assets and national digital currencies opens up completely new prospects for financial management. These technologies simplify investment operations and make transactions more convenient and transparent. In the context of increasing competition in mobile banking, solutions such as intuitive applications, intelligent chatbots and platforms for personalized interaction are sought out most. They are aimed at creating a comfortable user experience, which helps not only to acquire new clients, but also to retain the current audience.

Open Banking technologies are becoming an important stage in the evolution of the banking sector, since they offer openness and expand access to financial services to a wider audience, including previously underserved user groups. Banking innovations today not only modernize the market, but also establish the basis for a new level of interaction with clients. This facilitates the creation of a favorable environment for the implementation of innovative solutions that open up a wide range of opportunities for businesses and users, contributing to the dynamic development of the fintech sector.”

Money transfers

In 2024, Russians increased the volume of money transfers to Uzbekistan by 29% to $11.5 billion. Thus, the share of transfers from Russian citizens in the total volume of remittances from abroad amounted to 77% last year.

At the same time, the total volume of money transfers from other countries to Uzbekistan increased by 30% compared to 2023, amounting to $14.8 billion. This is explained by positive trends in the field of labor migration.

Venture capital market

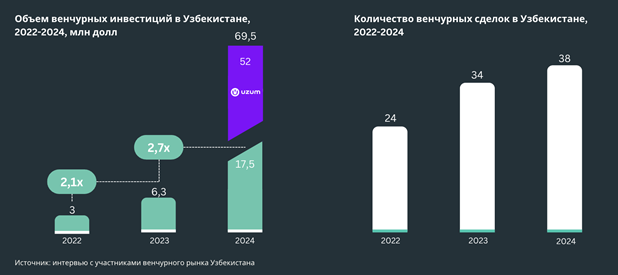

In 2024, venture investments in startups in Uzbekistan reached $17.5 million. In addition, last year was marked by the emergence of the first unicorn in Uzbekistan - Uzum - with $52 million raised. At the same time, the total volume of other investments in Uzbek startups increased by 2.7 times, and the average deal size exceeded the figures for previous years by almost four times. The FinTech & Retail CA website received such data from KPMG experts. RISE Research, in collaboration with KPMG, EA Group, BGlobal Ventures and MA7 Ventures, conducted a large-scale study of the venture market in Central Asia for 2024. The report covers more than 200 startups and includes expert opinions from 40 industry leaders. In general, the venture capital market in Central Asia was expected to reach $95 million in 2024. The Uzbek market grew 2.7x to $17.5 million across 38 deals, with the average deal size quadrupling to $460,000. Local investors provided 52% of funding. The launch of five new venture funds in Q1 2025 indicates growing activity, although early-stage investments still prevail in the market.

As Erke Asemova, Associate Director, Advisory, Strategy and Operation at KPMG Caucasus and Central Asia, notes: “The venture market of Uzbekistan demonstrated almost threefold growth in 2024. This is attributed to the increased activity from both public and private funds, as well as a significant rise in angel investments.

Angel investor clubs are being established in the country, and there is a growing willingness among investors to consider not only traditional investments but also startup funding.”

“The emergence of Uzum as the first unicorn in Uzbekistan marks a new era for the venture market of Central Asia. At EA Group, we are proud to support startups striving for global success and encourage entrepreneurs in the region to boldly enter international markets, pushing the boundaries,” says EA Group CEO Erik Aubakirov.

According to the researchers, the venture capital market of Uzbekistan is still focused on the early stages as regards the number of deals, with most of them in 2024 being in pre-seed and seed rounds, but the size of investments began to prevail at the growth stage. At the same time, the key sectors such as AI, FinTech and EdTech remain the most active in terms of the number of deals, while HealthTech and FinTech attracted the largest volumes of investment.

In the past four years, many new venture funds have emerged in Uzbekistan, which shows a growing interest in the country's startup ecosystem. From January to March 2025 alone, five more new funds were opened, increasing the availability of capital for startups.

So, the venture market of Uzbekistan continues to strengthen, and the emergence of new funds, as well as the increase in deals in key technology sectors, indicates the formation of a robust investment infrastructure. This opens up new prospects for startups and facilitates the country's integration into the global venture ecosystem.

P. S.

Over the years of work in the Central Asian region, PLUS-Forums have proven to be the most effective platform to search new customers and develop relationships with existing ones. According to the participants, PLUS-Forums are a unique tool designed to support and develop business, to establish new business contacts with industry participants and build communications with market regulators.

Become a part of this large-scale event! Get registered now and attend the International PLUS-Forum “Digital Uzbekistan” to be held on May 28-29, 2025 in the capital of Uzbekistan. For registration, click here.

On behalf of the Steering Committee, we wish all of us to work hard in Tashkent, establish new business contacts and exchange experiences!

We are confident that the PLUS-Forum will further remain a unique inter-industry “meeting place” for productive business communication of market participants and professional experts and serve, at the same time, as a powerful impetus for the development of the Central Asian economy! Besides, we recommend that our entire audience closely monitor the new countries and regions we open for our activity every year, and those will be the Caucasus, Asia, and, highly likely, Africa. We are sure that these regions will be all too interesting for both specialized companies and entities of Uzbekistan, and for representatives of government agencies and banking community of any country in Central Asia and other regions.

A journey of a thousand miles begins with a single step!

See you at the Forum in Tashkent!