15:44, 2 July 2018

3883 views

3883 views

From July 1, Russian banks begin to collect customer biometrics. How will this work?

The Unified Biometric System (EBS) was launched in Russia on July 1 to allow banks to collect biometric customer data used for remote customer service.

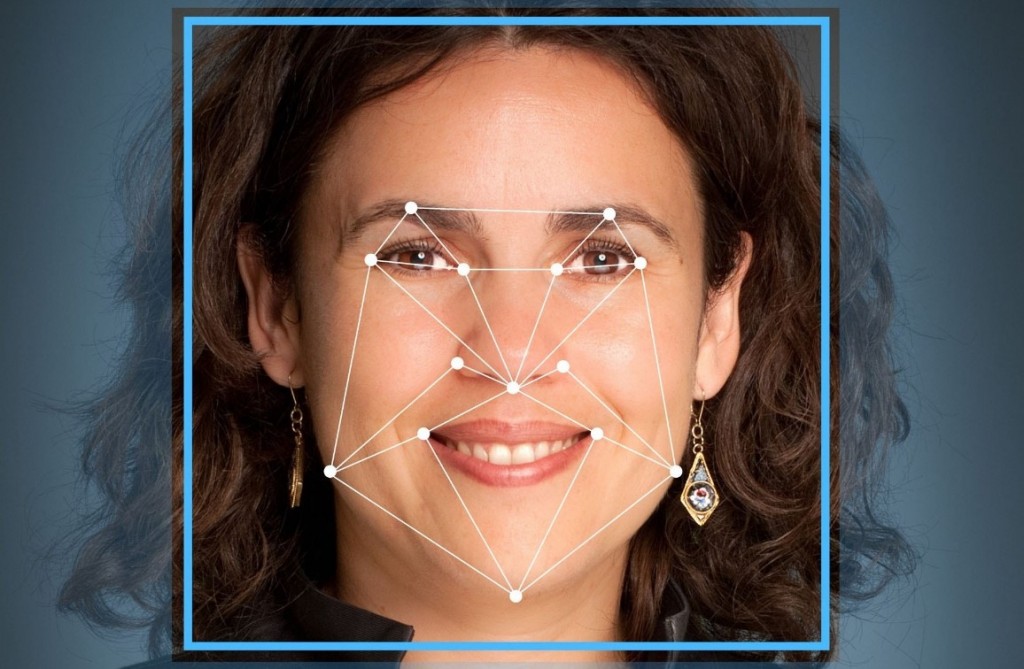

The Unified Biometric System (EBS) was launched in Russia on July 1 to allow banks to collect biometric customer data used for remote customer service.Identification of Russians will be carried out through the Unified Identification and Authentication System (ESIA), with the biometric data verified via the EBS platform using two identification parameters: a voice profile and a photo image.

Rostelecom, the system operator since June 30, will be responsible for collection, processing and storage of biometric personal data, as well as verification of their correspondence to the biometric parameters initially captured. Banks will have to pay Rostelecom a 200-ruble fee for each customer's call to the EBS.

Twenty banks start the collection of biometric data of Russians on July 1. All Russian banks compliant with the requirements set by the Bank of Russia will be connected to the system. The qualification criteria for credit institutions wishing to join the biometric platform include the bank's membership in the deposit insurance system, the non-involvement in a bankruptcy procedures and the absence of any special resolution of the Bank of Russia in regard to the bank. The short list of eligible credit institutions where citizens can get registered with the ESIA and the Unified Biometric System will be published on the website of the Central Bank of the Russian Federation.

Sberbank spokesmen told the PLUSworld.ru portal that nothing would change for their existing customers. The key benefit for a customer when using the EBS is the ability to become a client of another bank without having to visit its branch for the purpose of identification. In other words, residents of distant locations can remotely become customers of a bank that does not have branches in that region. At the same time, immediately after the launch the system will not be so popular and its impact on the banking system will be limited.

How can customers onboard the EBS and start receiving banking services remotely?

A citizen will only have to visit the bank once to open an account. The credit organization staff will help him/her to get registered in the ESIA on the Unified Public Services Portal (Gosuslugi.ru), if the user didn’t do so earlier. After that, the assistant will take the user's biometric data – a photo and voice – and upload them to the EBS.

Clients identified with the help of EBS will be offered the same services as the customers who opened an account visiting the branch personally: opening accounts and deposits, issuing cards, applying for a loan and receiving it if approved by the bank, as well as making all payments and transfers available to the clients of the bank.

On top of that, once registered in the system, a citizen can enjoy the remote services of any bank connected to it. To do this, the client just needs to enter the login / password at the public services portal and say a verification utterance, generated by the system, in front of the smartphone or computer camera.