16:28, 27 December 2024

1034 views

1034 views

Digital Tajikistan: a unique platform to accelerate the digital transformation of Tajikistan

The International PLUS-Forum Digital Tajikistan, one of the largest events in Central Asia, was held in Dushanbe on 25 November, 2024. The event was supported by the Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan and the National Bank of Tajikistan.

Полный фоторепортаж о том, как проходил ПЛАС-Форум «Digital Tajikistan»

“Digital Tajikistan”, the new edition of the International PLUS-Forum, is focused on the current state and topical issues of digitalization of the public infrastructure, the retail financial services segment, and the industry of retail trade and e-commerce of the Republic of Tajikistan.

Digital Tajikistan opening ceremony

Digital Tajikistan opening ceremony

Shortly before the Forum, the Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan, together with its partners, organized the Week of Innovation and Digital Transformation in Tajikistan, which was held on 18-24 November, 2024.

Digital Tajikistan has already managed to announce itself to be the most visited event in the industry in terms of both audience size and composition – business owners, top managers and key employees. Over 1,400 delegates applied for participation in the PLUS-Forum.

It is significant that the event, supported by the Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan and the National Bank of Tajikistan, was attended by a number of ministers who determine the digitalization processes in the country, as well as representatives of the leadership of relevant departments and associations.

Digital Tajikistan has already managed to announce itself to be the most visited event

Digital Tajikistan has already managed to announce itself to be the most visited eventIn turn, the international dimensions of the event have been clearly demonstrated in many respects, including the participation of 10 ambassadors to Tajikistan representing the United Kingdom, Germany, India, Iran, China, Korea, Pakistan, Palestine, France and Türkiye.

The number of speakers exceeded 120, while more than 30 exhibitors from 26 countries, including Germany, Iran, China, the UAE, the USA, Türkiye, France, Japan and others, presented their products, technologies and services at the exhibition.

Digital Tajikistan, the new PLUS-Forum edition, was also marked by a number of significant agreements signed by market participants.

PLUS Group and OJSC “Certification Centers, Public Services and Digital Programs development”

PLUS Group and OJSC “Certification Centers, Public Services and Digital Programs development”

PLUS Group CEO Konstantin Grizov signed Memorandums of Cooperation with Khakimjon Kodirov, CEO, OJSC Certification Centers, Public Services and Digital Programs Development.

Memorandums of Cooperation were also signed between PLUS Group and the E-Commerce Participants Association of the Republic of Tajikistan, the National Association of Small and Medium Businesses of the Republic of Tajikistan, the Association of Financial Organizations of Tajikistan and the Association of Digital Development of Tajikistan.

The Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan signed Memorandums of Cooperation with the Association of Digital Development of Tajikistan and the Association of Financial Organizations of Tajikistan.

OJSC “Certification Centers, Public Services and Digital Programs development” and Huawei Technologies Tajikistan LLC

OJSC “Certification Centers, Public Services and Digital Programs development” and Huawei Technologies Tajikistan LLC

A historic document in the form of a memorandum of cooperation was signed between OJSC Certification Centers, Government Services and Digital Programs Development, represented by its CEO Khakimjon Kodirov, and Huawei Technologies Tajikistan LLC, represented by its CEO Ma Tian.

Central Asian Fintech Association и IT park

Central Asian Fintech Association и IT park

В свою очередь Otabek Nasyrov, Chairman of the Central Asian Fintech Association, signed a memorandum of cooperation with IT park (Technological park of software products and information technologies) represented by Director Temur Khisamutdinov.

The Central Asian Fintech Association signed memorandums of cooperation with the Association of Financial Organizations of Tajikistan, the Association of Banks of Tajikistan, the National Association of Small and Medium Business of the Republic of Tajikistan, the E-Commerce Participants Association of the Republic of Tajikistan, and Alif Bank.

Similar memorandums were signed by IT park with Innotech and Service Technologies.

Key sponsors of the PLUS-Forum Digital Tajikistan:

Title sponsor:

HUAWEI

HUAWEI∙ HUAWEI

General Sponsor:

Dushanbe City (DC)

Dushanbe City (DC)

∙ Dushanbe City (DC)

The full list of Partners, Sponsors and Media Partners of the International PLUS-Forum “Digital Tajikistan” is available here.

The PLUS-Forum “Digital Tajikistan” was opened with a session “Further digitalization of the country: opinions of the heads of ministries and agencies of Tajikistan” , attended by a number of ministers who determine the digitalization processes in the country, top managers of relevant agencies and associations, as well as key leaders, innovators and experts in the digital transformation of the republic.

PLUS-Forum Steering Committee Deputy Chairman Konstantin A. Grizov

PLUS-Forum Steering Committee Deputy Chairman Konstantin A. Grizov

Whenopening the working program of the PLUS-Forum “Digital Tajikistan”, PLUS Group CEO and Steering Committee Deputy Chairman Konstantin Grizov, noted that the event is being held with the assistance of the Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan and the National Bank of Tajikistan, and it is one of the most significant events for the financial sector of Central Asia.

Steering Committee Chairman Alexander I. Grizov

Steering Committee Chairman Alexander I. Grizov

Further on, as tradition has it, PLUS-Forum Steering Committee Chairman Alexander Grizov greeted the PLUS-Forum delegates with his welcoming speech to note, in particular, the following: “Digital Tajikistan is a new platform we are organizing in a promising market such as Tajikistan. Today, almost all the leaders, innovators and experts of digital transformation are here with us, ready to discuss the key issues of the digital future of Tajikistan. We have gathered to analyze the most pressing issues of business and technology development, digital infrastructure of the state, cybersecurity – to name just a few. Our new edition of the PLUS-Forum is a unique platform to exchange ideas on the most promising topics and create partnerships that will accelerate the digital transformation of this wonderful country.”

Officials of the Republic of Tajikistan and representatives of friendly countries also addressed the audience with welcoming speeches.

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Hakim Ismoilzod, First Deputy Director, Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan: “We welcome the participants of the first international PLUS-Forum “Digital Tajikistan”! The Republic of Tajikistan is taking sure steps towards the innovations in various fields, digital transformation, formation of e-government, economic development and a common digital future.

We are confident that with such international events, the goals set by the country's top leadership and the Government of the Republic of Tajikistan will be given the most advanced treatment, and the introduction of innovations and digital technologies will pick up momentum.

Ministry of Economic Development and Trade of the Republic of Tajikistan

Ministry of Economic Development and Trade of the Republic of TajikistanZavki Zavkizoda, Minister of Economic Development and Trade of the Republic of Tajikistan: “President of Tajikistan, esteemed Emomali Rahmon, quite rightly noted that under the current conditions, the development of digital technologies is central to the competitiveness of the economy. Taking into account this priority, the government of the country, in cooperation with the public sector and with the support of development partners, has implemented a number of significant initiatives in the field of digitalization of the national economy. First of all, the Concept of the Digital Economy and the Medium-Term Program for the Development of the Digital Economy for 2021-2025 have been adopted and are being implemented. These strategic documents and national programs cover the digitalization process in 17 sectors of the national economy. I see that representatives of various organizations are participating in the PLUS-Forum, and I hope that in their reports they will present information related to digital development work.”

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Khurshed Mirzo, Director, Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan, made the following statement: “I am proud that today Tajikistan has become a platform for international and regional events within the framework of the creative endeavors of Leader of the Nation, President of the Republic of Tajikistan Emomali Rahmon.

I am confident that during this event, being a logical continuation of the Week of Innovation and Digital Technologies, the most important issues will be discussed, new opportunities for cooperation and prospects for mutually beneficial relations will be opened.

In the course of implementing the set goals, the formation of an economy based on digital technology takes on a special significance.

Customs Service under the Government of the Republic of Tajikistan

Customs Service under the Government of the Republic of Tajikistan

Khurshed Karimzoda, Head of the Customs Service under the Government of the Republic of Tajikistan, provided comprehensive information on the process of customs digitalization. “Based on the instructions and directives of President of the country Emomali Rahmon, the Medium-Term Program for the Development of Customs Authorities of the Republic of Tajikistan for 2020-2024 was adopted. It provides for the digitalization of customs authorities and sets the key indicators for the development of customs authorities of Tajikistan. The Program implementation was launched taking into account both current customs restrictions and opportunities for investment raising. In the course of this process, the Customs Service introduced a “single window” system for processing export, import and transit operations. The system, effective from 1 September, 2020, embraces 11 public bodies and social institutions to become one of the first steps towards the digitalization of customs activities.

State Committee on Investments and State Property Management of the Republic of Tajikistan

State Committee on Investments and State Property Management of the Republic of Tajikistan

Khurshedai Kodir, Deputy Chairman, State Committee on Investments and State Property Management of the Republic of Tajikistan, said: “The digital ecosystem as the main tool for investment raising and effective state property management is an important issue and an integral part of the strategy for sustainable development of Tajikistan. Given this, we are confident that the introduction and energetic development of digital platforms and infrastructure will ensure a competitive advantage for investors, help create new jobs and make the investment environment more attractive.”

National Bank of Tajikistan

National Bank of Tajikistan

In his opening address, Deputy Chairman of the National Bank of Tajikistan Sirojiddin Ikromi, expressed gratitude to the Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan, to the organizer of the PLUS-Forum represented by PLUS Group, and other organizations that contributed significantly to the holding of this Forum.

According to him, the event brought together representatives of various ministries and departments, the banking community, international financial institutions, as well as leading specialists and experts. This forms a unique platform for exchanging views on current issues of digitalization of the financial market

“Digitalization is a key element of the sustainable development of any economy, and the financial sector plays a vital role in this process. The banking system of Tajikistan is one of the leaders in the adoption of modern technologies and digitalization of the financial sector. The banking system is being developed through infrastructure reforms, financial innovations and expansion of modern electronic technologies, which dramatically transforms traditional methods of banking and financial services,” the speaker noted.

Bakhodur Rahimzoda, Deputy Director of the Agency for Export under the Government of the Republic of Tajikistan, was another speaker who addressed the PLUS-Forum participants with a welcoming speech. Organization and holding of such international forums allows responsible officials to discuss and consider industry issues and make appropriate decisions to fix existing problems, he said.

During the dialogue, the participants touched upon a number of the most pressing topics, such as:

- Digital ecosystem for investment raising and state-owned assets management

- Development of the digital economy and its impact on the development of Tajikistan

- E-commerce and its role in increasing Tajikistan's export potential

- Digitalization of customs operations to improve export-import processes

- and a lot more.

Ambassador of the People's Republic of China to Tajikistan Ji Shumin emphasized the importance of the digital economy as the basis for transforming the global economy.

According to him, “the Chinese party is ready to share advanced technologies and experience in the field of digitalization with Tajikistan. First of all, this involves building the communication infrastructure in remote regions of the country. We are also ready to help implement the digital economy in the social sphere, strengthen cooperation in such sectors as e-government, smart medicine and education. We are also ready to promote cooperation in the field of e-business and electronic document management in order to simplify cross-border trade. China is ready to develop comprehensive cooperation relations with Tajikistan to increase both countries’ competitiveness in the international market as regards digitalization of the financial sector and the digital economy.”

Сooperation agreements at a high level were signed in the following areas:

- creation of information and communication infrastructure;

- adoption of the digital economy technology in medicine, education and other sectors;

- development of artificial intelligence (AI), cloud computing and work with big data;

- joint scientific research and creation of laboratories.

According to the Chinese Ambassador, the implementation of joint projects will accelerate the digitalization process in Tajikistan and expand trade and economic cooperation between the two countries.

Huawei Middle East and Central Asia

Huawei Middle East and Central Asia

Vice President of Huawei Middle East and Central Asia Tong Liu (Tong Liu), “It is a great honor for me to participate in the opening of the PLUS-Forum Digital Tajikistan together with outstanding speakers. We are happy to see that the digital transformation processes in Tajikistan are continuously accelerating, especially under the leadership of the Agency for Innovation and Digital Technologies, and the country is successfully entering the era of smart technologies.” According to the speaker, “Huawei, as a key player in the digitalization sphere in Tajikistan, tirelessly introduces the most innovative technologies. Over the past 19 years, Huawei has been committed to making digitalization accessible to every person, home, organization in a bid to build a fully intelligent Tajikistan, as well as the entire Middle East and Central Asia region.”

State Unitary Enterprise “Smart City”

State Unitary Enterprise “Smart City”

Sadi Samadzoda, Director, State Unitary Enterprise “Smart City” under the Executive Authority of the city of Dushanbe, discussed the progress of digital transformation of the capital. As part of the “smart city” concept, initiatives are being implemented that are aimed not only at the city infrastructure modernization, but also at improving the quality of life of citizens.

Major projects already implemented:

- Electronic government: simplifying document flows between government agencies.

- Smart services: digitalization of education, healthcare and transport.

- Free Wi-Fi: providing access in public spaces, parks and transport.

- Environmental solutions: development of the “green economy”.

- Electronic city map: a tool for convenient navigation and infrastructure management.

In general, issues of further digitalization of Tajikistan, including the digital economy development and the infrastructure modernization, became key topics of the first session of the International PLUS-Forum “Digital Tajikistan”.

Ministry of Finance of the Republic of Tajikistan

Ministry of Finance of the Republic of Tajikistan

Among other officials present at the PLUS-Forum were Deputy Minister of Industry and New Technologies of the Republic of Tajikistan Bakhtiyor Safarzoda, and Deputy Minister of Finance of the Republic of Tajikistan Dilshod Saidzoda.

Ministry of Industry and New Technologies of the Republic of Tajikistan

Ministry of Industry and New Technologies of the Republic of Tajikistan

Tajikistan is uniquely positioned to adopt advanced technologies. This was noted first of all during the session “Development of Tajikistan as a modern digital society”.

The session was moderated by:

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

- Hakim Ismoilzod, First Deputy Director, Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan, and

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

- Isfandiyor Yazdonzoda, Deputy Director, Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan.

Natalia Malyarchuk

Natalia Malyarchuk

In her speech, Natalia Malyarchuk, Public Affairs Consultant, specialist in public administration in the СА region, Head of GR Practice at Markets Mentor, spoke in detail about the specifics of digital markets regulation in Central Asia. The speaker emphasized the need to standardize and improve the regulation of digital markets. The main challenges for Tajikistan include:

- developing a legislative framework for digitalization;

- reducing the share of the state in digital markets;

- developing ICT infrastructure and stepping-up dialogue with the private sector.

In general, the Central Asian region is seeing important changes: tightening antitrust regulation, localizing data, and adapting new technologies.

Alina Imangazina, Head of the Payment Systems Policy Division, Payment Systems Department, National Bank of the Republic of Kazakhstan, emphasized that the rapid development of mobile technologies has become a significant driver of innovation in the financial sector.

In her speech, she highlighted several important points:

- Investments in digital channels

Competition in the banking sector has intensified, prompting banks to energetically expand mobile and Internet banking. Today, mobile applications have become a key channel for providing not only financial but also public services.

- Government support and regulatory framework

- Technologies of the future

- Implementation of smart contracts that can become the basis for new financial products.

- Development of central bank digital currencies (CBDC) as a new instrument of monetary policy.

- Use of artificial intelligence to optimize financial services.

- Personal data management and creation of information bases as a new competitive advantage.

- Social effect

The integration of government services into mobile applications allows citizens to stay informed about taxes and fines, which contributes to a better transparency and convenience for users. Alina Imangazina also noted that such initiatives lay the foundation for new stages of digitalization and make Kazakhstan a regional leader in the development of fintech. The speaker highlighted the successes of Kazakhstan, where non-cash transactions have grown 47 times and non-cash payments in retail have amounted to 89% in 7 years. These figures can also become a kind of benchmark for Tajikistan.

Zhanna Dyussenbina

Zhanna Dyussenbina

Zhanna Dyussenbina, Director for Government Engagement for Central Asia, Visa, emphasized the importance of digitalizing public services. According to her, citizens expect the same convenience from the government as from banking or commercial platforms, and digital technologies can be introduced into government procurement, payments, and SME support. This will not only create convenience for citizens, but also increase the transparency of governance.

Huawei

Huawei

According to Dmitry Konarev, an expert and solutions architect at Huawei, the national digital transformation can become an important driver of economic growth. He noted that by 2030–2050, the world will enter the era of the fifth industrial revolution, where the intelligent economy will become the basis for development.

For Tajikistan, this means:

- Creation of a digital infrastructure for data processing and its intelligent use.

- Implementation of advanced technologies similar to those that helped China’s digital economy rank second in the world.

Elena V. Son-LaRocco, Executive Director, the American-Uzbekistan Chamber of Commerce (AUCC) and the US-Tajikistan Business Council (USTJBC), emphasized that digitalization plays a key role in the economic development of Tajikistan.

The expert noted that Tajikistan is uniquely positioned to implement advanced technologies such as artificial intelligence, blockchain, and cloud services. According to her, these tools can streamline supply chains, increase transparency, and integrate the country into the global economy.

Sobir Vazirov, Head of Tax Legislation Improvement, Tax Committee under the Government of the Republic of Tajikistan, noted that the country continues to energetically develop the digitalization, seeking to increase the efficiency of tax administration and improve interaction with taxpayers. The speaker also specified the following areas of digitalization in the tax sphere:

- Digital registration of taxpayers;

- Online payment of taxes;

- Tax desk audit;

- Notifications of taxpayers;

- Risk identification and tax monitoring;

- Labeling of goods through digital services.

To increase the transparency of commodity turnover, the country has introduced a digital labeling system that allows monitoring the origin of goods and their compliance with standards.

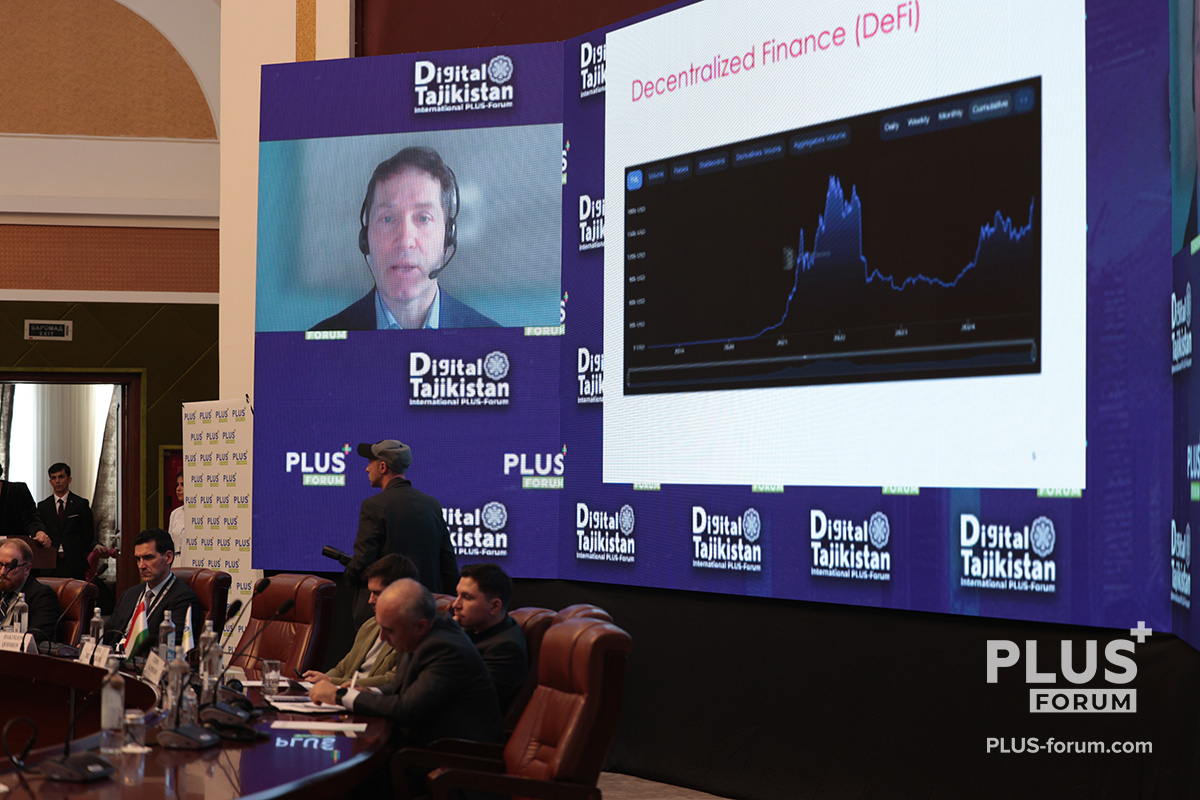

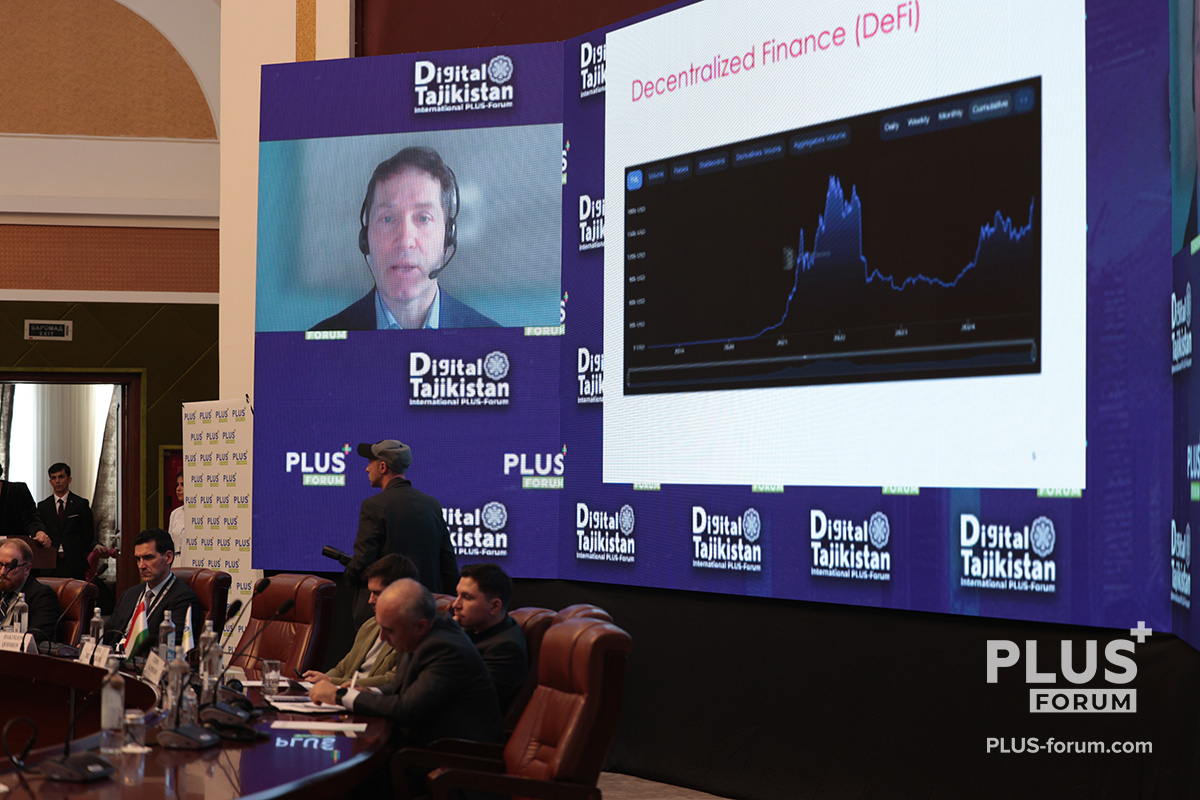

Blockchain-based technologies have laid the groundwork for many innovations in the financial sector. This thesis was expressed during the session “Payments Business and Technology”.

Zebunniso Fattidinova

Zebunniso Fattidinova

The session was moderated by Zebunniso Fattidinova, Executive Director, Association of Financial Institutions of Tajikistan (AFOT). According to her, “today, a long-awaited event for all market participants has taken place: the PLUS-Forum, well-known in Central Asia, has finally come to Tajikistan.”

Horst Treiblmaier

Horst Treiblmaier

Dr. Horst Treiblmaier, Professor at Modul University Vienna (Austria), spoke about the transformation of the financial industry under the influence of blockchain technologies.

Hе paid special attention to the concept of decentralized finance (DeFi), which already offers banking services without involvement of banks. Services such as lending, currency exchange, insurance and even asset management are carried out using software code recorded in the blockchain. This makes financial services accessible, fast and secure.

He also noted that blockchain is not just a technology, but an entire ecosystem that includes cryptography, consensus mechanisms, and decentralized data storage systems. This allows creating platforms where data cannot be changed, which opens up new business opportunities.

“Blockchain is not just a game changer, it sets new standards for the entire industry,” professor Treiblmaier concluded, adding that these technologies form the foundation for the future of both the financial sector and the global economy.

National Bank of the Republic of Tajikistan

National Bank of the Republic of Tajikistan

Furqat Rahmatov, Deputy Director of Payment Systems Department, the National Bank of Tajikistan, spoke about the key achievements and plans for the development of the country's payment system. The speaker emphasized that modern technologies are becoming the basis for providing convenient and affordable financial services to the population. In recent years, Tajikistan has made significant progress in the field of payment technologies. Among the key achievements, he highlighted the introduction of a national payment system, which laid the foundation for the development of retail payments and digital services. In addition, Furqat Rahmatov pointed out the importance of adopting the law “On Payment Services and Payment Systems", which opened up legal opportunities for the introduction of innovations such as mobile banking, QR codes and agent banking.

Among the key achievements of 2023, Furqat Rahmatov highlighted the introduction of a single QR code system that stitched together the solutions of all financial institutions.

Regarding the future plans, Furqat Rahmatov said that the National Bank is doing the groundwork for creating a single electronic center, which will become a platform for the further development of payment services.

Olim Karimov

Olim Karimov

Olim Karimov, Head of Information Security, Processing center MTM, took an active part in the dialogue. He spoke about his company's contribution to the development of Tajikistan's payment infrastructure. Over a million active cards, 60 million transactions per year that have passed through a full routing cycle, and an annual turnover of 50 billion somoni (about USD5 bn) – that’s what MTM is today.

UpCode

UpCode

Vadim Zhelyaskov, CEO, UpCode, discussed trends in the state-operated fintech as a product by the example of creation of an instant payments system in Moldova. The expert drew parallels between the current strategic tasks of Tajikistan and those of Moldova in terms of digitalization, noting the need for creating new ways of interaction between the state and the population. He took as an example the digital public procurement system recently established in Moldova, which allowed 95% of public procurement in the republic to go digital. He also spoke about the advantages of an electronic system for G2C payments. The speaker paid special attention to the implementation of an instant payments system in all banks of Moldova – the implementation of the national-scale project took as few as 9 and 12 months for individuals and legal entities, respectively.

S1LKPAY

S1LKPAY

Gani Uzbekov, Founder and CEO of S1LKPAY, dwelled on the topic “Share2Pay as an alternative to cross-border transfers and payments.” According to the expert, this approach allows for almost instant money transfers through immediately issued virtual cards, as well as for withdrawals of cash transfer amounts at ATMs. Gani Uzbekov paid special attention to the capabilities of the S1LKPAY digital wallet. “Our main goal is to help people extend financial support to their family and friends wherever they might be,” he said.

eComCharge UAB

eComCharge UAB

Alexander Mikhailovsky, Co-founder and Chief Product Officer, eComCharge UAB, reported on “Fast and secure launch of online payment acceptance service for banks and fintech companies in Central Asia”, where he informed about the “white label” implementation of the beGateway WLS product. The speaker noted that the product functionality covers the full range of modern customer needs, including dealing with cryptocurrencies, integration with international payment systems, etc. In turn, the security of transactions is ensured through the support of both local and global tokenization, as well as through compliance with the latest PCI versions.

ACCION International

ACCION International

International expert Brian Kuwik, SVP, Central Asia at ACCION International (USA), dwelled on the topic of small business digitalization in Central Asia. He noted that in recent years, he has opted to focus his work on the optimization of interaction between banks and fintech structures in Kazakhstan and Uzbekistan.

Банк Эсхата

Банк Эсхата

Nosir Oripov, Head of Retail Business, Eskhata bank, noted that one of the main trends aimed at the deeper digitalization of the financial sector of Tajikistan is a mental paradigm shift in the consciousness of the entire society. The key thesis of his report was the resistance of the human factor to any mass innovations. As the speaker noted, all changes occur at three levels – mental, strategic and operational. He paid special attention to the issues of implementing changes at the mental level, which require effective communications between the bank and the client.

Payments business and Technology

Payments business and Technology

At the end of the dialogue, the speakers came to the unanimous opinion that the technological innovations strengthen Tajikistan's position in the field of digitalization, and the improvement of payment systems will help meet the growing needs of both the population and business as a whole.

The methods used by cybercriminals to penetrate the network infrastructure of organizations were discussed by experts at the session “Cybersecurity. Cyber threats and information security in the banking sector”.

TSARKA GROUP

TSARKA GROUP

The session was moderated by Polat Tokhtakhunov, Deputy CEO, TSARKA GROUP (Kazakhstan). Being a speaker at the same time, he reviewed the prospects for implementing the Bug Bounty strategy, which is becoming an alternative to traditional audit. The speaker informed about the main components of protecting organizations in the financial sector.

Pacifica

Pacifica

Igor Savin, Executive Director, Pacifica, dwelled on who attack banks today and how. The speaker offered a detailed review of cyber groups, and also talked about how cybercriminals penetrate the network infrastructure of organizations.

Ivan Lichmanov, CEO, WhyHappen, noted that fraudsters’ tactics are rapidly evolving today, and sophisticated criminal schemes affecting funds that can be managed online, don’t often look like fraud. The speaker also revealed the specifics of practice of implementing a cross-channel anti-fraud system.

Compliance Сontrol & Rakasta

Compliance Сontrol & Rakasta

Arkady Prokudin, Chief Commercial Officer, international consulting group Compliance Control & Rakasta, devoted his speech to the key points of cybersecurity and compliance strategy. The speaker gave specific recommendations on vulnerability management on the client side.

Silmon Mavlonazarov

Silmon Mavlonazarov

Silmon Mavlonazarov, Senior Researcher, Research Institute of Political Processes, Diplomacy and Globalization, spoke about the threats and dangers of cybercrime in modern times.

Asomudin Atoev

Asomudin Atoev

Elimination of customer vulnerability as a reflection of the low digital security culture of the bank – this was the subject of the report made by Asomudin Atoev, expert on ICT for Development, Academy of Public Administration under the President of the Republic of Tajikistan.

“Cybersecurity. Cyber threats and information security in the banking sector”

“Cybersecurity. Cyber threats and information security in the banking sector”

Dilshodbek Ganiev, Director of IT Department, National Bank of the Republic of Tajikistan, told the audience about the main cyber threats and information security in the banking sector.

Participants of the session “Islamic finance and Islamic banking in Central Asian countries. Current state and prospects” discussed how these trends and services meet the needs of the Muslim population, attracting the attention of international investors.

The session was moderated by Nargis Podchoeva, Operations Officer, Middle East, Central Asia, Türkiye, Pakistan & Afghanistan, International Finance Corporation (IFC).

Kibriyo Urakova

Kibriyo Urakova

Kibriyo Urakova, Ph.D., Head of Islamic Banking Supervision, National Bank of Tajikistan, spoke about the efforts the government makes to create a favorable environment for Islamic finance:

- Membership in the Islamic Financial Services Council (since 2010): development of international standards

- Amendments to the Tax Code (2022): legalization of Islamic banking operations

- Current structure: one full-fledged Islamic bank, three Islamic banking counters, and three financial institutions with licenses pending.

- The National Bank, together with the Asian Development Bank, is developing monetary instruments for Islamic finance, which pledge growth of this sector.

Dehqon Samadov

Dehqon Samadov

Dehqon Samadov, Head of Islamic Finance and Business Development, Tawhidbank, spoke about the bank's transformation into an Islamic bank. This process began in 2017 and was completed upon receipt of a license in 2019. Among the bank's key achievements are the network of 5 branches and 33 service centers, 108 thousand clients and 96 thousand payment cards in issue. The bank offers a full range of Islamic banking services, including digital products. According to the expert, the prospects for the Islamic finance development in Tajikistan include the development of Islamic mortgages and financing of the green economy, further popularization of Islamic insurance and the Islamic securities market.

Madina Tukulova

Madina Tukulova

In her online presentation,Madina Tukulova, Head of Islamic Finance, Astana International Financial Centre (AIFC), provided data on Islamic banking in Kazakhstan. Currently, there are three Islamic banks and two Islamic leasing companies operating in the country. The most popular products are Islamic mortgages, auto loan financing and deposits. The AIFC energetically invites issuers of Islamic securities and opens opportunities for their issue, including dual and cross-listing.

Lyudmila Bogushevskaya

Lyudmila Bogushevskaya

Lyudmila Bogushevskaya, CEO, LB Consulting, highlighted the importance of an integrated approach to the practical implementation of Islamic finance. In her opinion, a combination of traditional and digital products should be widely introduced, providing services integrated into the daily life of Muslims. A very important factor, she believes, is training and improving the financial literacy of the population. Despite the projected annual growth of 10% until 2029, Islamic banking faces a low level of awareness among the population (10% in Kazakhstan), which requires proactive work with the younger generation.

Timur Mukhtarov, Chief Marketing Officer, Tayyab Finance Kazakhstan, presented the first Islamic fintech startup in the country. The company is primarily focused on Islamic auto lending, which demonstrate high demand among the population.

Islamic finance and Islamic banking in Central Asian countries. Current state and prospects

Islamic finance and Islamic banking in Central Asian countries. Current state and prospects

The prospects for the implementation and use of financial services were discussed by participants of the session “Digital services without borders. Open Banking: present and future. Banking infrastructure and self-service”..

Shavkat Kalonov

Shavkat Kalonov

The session was moderated by Shavkat Kalonov, Partner at Top Consulting, specialist in Business Transformation and Digitalization.

Evgeny Korenkov

Evgeny Korenkov

The session opened with a speech by Evgeny Korenkov, Trade Representative of the Russian Federation in Tajikistan. He noted that the digital development of Tajikistan goes at a fast pace, partly owing to Russian IT companies’ participation in respective projects and their investments: “I would like to join the words of gratitude already said here to the organizers for the high level of preparation and the relevance of holding such an event in the republic. In recent years, digitalization has been gaining momentum in Russia, with digital solutions, including those based on AI, being introduced into all areas. Particular attention is paid to the digitalization of public administration, a nation-wide cloud ecosystem is being developed, work is being transferred to large platforms based on the state automated management and electronic budget system... In Russia, there are large IT market players who have not only passed through their own digital transformation successfully, but are already setting trends based on the experience gained. In our opinion, it is obvious that the involvement of Russian companies will significantly accelerate the digital development of Tajikistan. And there is already clear evidence of this.”

According to Evgeny Korenkov, “in recent years, digital commerce has been developing dynamically in Russia, with impressive figures being achieved in the popular marketplaces such as Wildberries, Ozon, Yandex.Market. And just two months ago, Wildberries confirmed its interest in entering the Tajik market by concluding a respective agreement with the Chamber of Commerce and Industry of Tajikistan.”

Rakhimjon Kurbonov

Rakhimjon Kurbonov

Rakhimjon Kurbonov, Senior Manager of Financial Services, MegaFon Tajikistan, spoke about their experience in creating the MegaFon Tajikistan digital ecosystem. According to the speaker, MegaFon Tajikistan services cover all customer needs today, from money transfers to booking tickets and paying for purchases, as well as fast loan and insurance services, and the scope of functions of a full-featured supermarket, with all the said available in a mobile application.

Freedom Bank Tajikistan

Freedom Bank Tajikistan

Dauren Nisinbayev, Acting Chairman of Management Board, Freedom Bank Tajikistan, shared his vision of the development of digital financial products. In his speech, he reviewed the key trends and opportunities of the market. As the speaker noted, the development of digital services in Kazakhstan is now possible primarily due to integration with GovTech. In turn, this means the digitalization of mortgages later followed by auto loans, including that in the secondary market. In Tajikistan, the bank plans to practice similar approaches to digitalization, using both IT and GovTech technologies. In conclusion, Dauren Nisinbayev emphasized that with the agreements already concluded, all the capabilities and competencies of Astana Hub will be available in Dushanbe in full.

DECO Systems

DECO Systems

Mikhail Shmitov, CEO, DECO Systems, spoke about the experience of building corporate data warehouses on the company's proprietary low-code platform to effectively solve business problems.

Arenadata

Arenadata

In turn, his co-speaker of Mikhail Shmitov Dmitry Sheranov, Director for International Business Development and Sales, Arenadata, noted that the company’s portfolio currently consists of more than 100 entities, including participants in the Central Asian markets, and the company is ready to support any heterogeneous landscape, including that located in the cloud. The company also has its own training center, so it offers training and consulting services to the clients.

IBS PROJECT

IBS PROJECT

Elena Akhtyrskaya, Sales Director, IBS PROJECT, reviewed how ATM service support models have been transforming in recent years. She analyzed the company’s own experience in Central Asia, including Tajikistan, where an incident management system was recently launched.

MyBPM

MyBPM

Oleg Bersenev, Founder and CEO, MyBPM, shared their best practices of digital transformation of business and banking services on MyBPM, a No-code platform: “easy and effective without involving a vendor.” He noted that true digitalization is a very resource-intensive task, requiring, among other things, the involvement of a large staff of programmers. Meanwhile, the industry is in need of such specialists: according to some estimates, their shortage will amount to 4 million in 2025. The speaker believes that the main criteria for successful transformation are continuity and timeliness. At the same time, when choosing a tool for digitalization, the speed of process implementation and independence, including that from the vendor, are important.

IT Service

IT Service

Islom Kodirov, Business Development Manager at IT Service, analyzed the future of microcredit: from microloans to complex digital ecosystems and modern banking solutions. He explained how the microcredit revolution in Central Asia is changing current models of financial services and what role innovative technologies play therein. According to the speaker, about 40% of the region's population have no access to banking services today, while this figure can amount to 70% in rural areas. Against this background, microcredit should play the role of an effective tool for economic growth.

Victor Dostov

Victor Dostov

Victor Dostov, international expert on regulation and infrastructure of digital financial services at IFC, Chairman of the Association of E-Money and Money Transfer Market Participants (AED), spoke about the potential of new financial products based on Open API. He focused on the issue of increasing the efficiency of interaction between various services and improving convenience for the end user. As an example, the speaker mentioned the possibility of issuing short-term insurance policies for the period of using car sharing services.

Alfa-Bank

Alfa-Bank

In the beginning of her report, Elena Tyatenkova, Senior Vice President, Head of Branch Management, Alfa-Bank, noted that “PLUS-Forum always gathers leaders!” She focused on the reorganization of bank branches. According to the speaker, physical branches, despite the development of remote service technologies, are still needed by the mass client. At the same time, branches must meet the modern demands of the client and bring profit.

Sinara Bank

Sinara Bank

Vitaly Kopysov, Innovation Director, Sinara Bank, also touched on the topic of Open Banking. The main refrain of his speech was the assertion that open banking is now an urgent need for any market, capable of changing the banking landscape we are accustomed to. During his speech, the expert analyzed the development of Open API in Russia over the past eight years, starting with the Faster Payment System and ending with the expected adoption of the legislative framework that would make open banking mandatory in the Russian Federation.

“Digital services without borders. Open Banking: present and future. Banking infrastructure and self-service”

“Digital services without borders. Open Banking: present and future. Banking infrastructure and self-service”

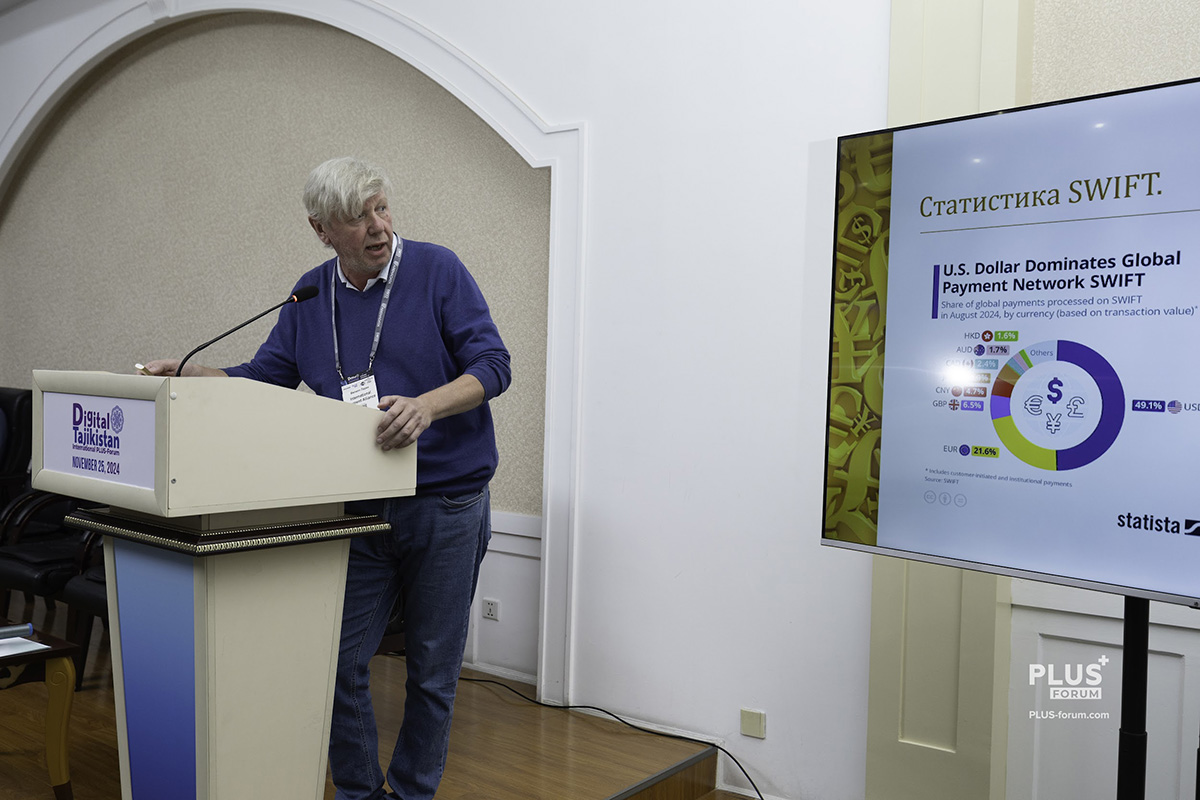

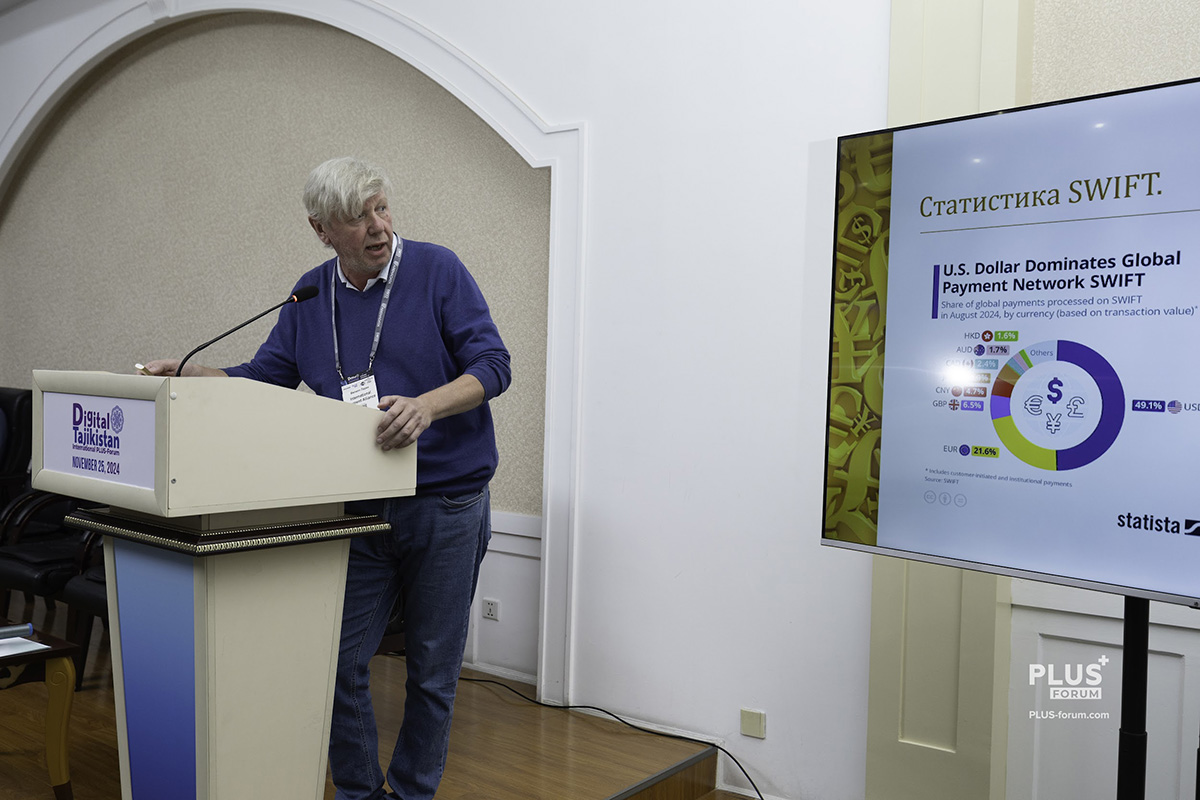

The session “Crypto industry. Trends, forecasts. CBDC 2024. Asset tokenization, fintech platforms and smart contracts. Blockchain”

was moderated by Otabek Nasyrov, Chairman of the Central Asian Fintech Association.

Natalia Romenskaya, CEO & Founder Strategy PLUS, Crypto & strategy consulting for CIS, dedicated her online report to the role of banks in the crypto industry.

International Payment Alliance

International Payment Alliance

Philipp Larin, Vice President, International Payment Alliance, spoke about the adoption of digital financial assets in cross-border settlements.

Promsvyazbank

Promsvyazbank

Активное участие в диалоге принял Dmitry Zlodiv, Head of Innovative Financial Technologies and Services, Promsvyazbank, took an active part in the dialogue. The topic of his report was “Digital Ruble. 12 months of the pilot project and development prospects”.

Central bank digital currencies (CBDCs) as a prospect of financial sovereignty for Central Asian countries – this topic was discussed by Andrey MikhailishinHead of the BRICS Pay Task Force, BRICS BC.

Nadezhda Surova, Director of Competence Center, Digital Economy; Member of the Digital Economy Council of the Federation Council, spoke about the possibility of using artificial intelligence for predictive cryptoeconomics.

Maria Bolobonova, lawyer, Partner at Belykh and Partners Bar Association, Member of the Expert Council of the State Duma of the Russian Federation on the legislative regulation of cryptocurrencies, reviewed the specifics of regulation of the tokenized asset markets.

Crypto industry. Trends, forecasts. CBDC 2024. Asset tokenization, fintech platforms and smart contracts. Blockchain

Crypto industry. Trends, forecasts. CBDC 2024. Asset tokenization, fintech platforms and smart contracts. Blockchain

As part of the Digital Tajikistan Forum, Magma Finance was awarded for long-term cooperation. PLUS Group CEO Konstantin Grizov handed over the diploma to the company head.

During the discussion “The role of development partners in supporting digital transformation: challenges, opportunities and prospects” experts emphasized the importance of coordinating efforts, improving the digital literacy of the population and modernizing the infrastructure.

Всемирный банк Таджикистан

Всемирный банк Таджикистан

The discussion was moderated by Ozan Sevimli, World Bank Group Country Manager for Tajikistan, who pointed out the need for a clear vision of the country's digital future. He placed the emphasis on the fact that digitalization is becoming a key element in most projects implemented today. The World Bank has already prepared a program of coordination with the Government of Tajikistan aimed at facilitating digitalization.

Mavzuna Shozodayeva

Mavzuna Shozodayeva

Mavzuna Shozodayeva National Macroeconomic Programme Officer, Swiss Cooperation Office in Tajikistan, presented a portfolio of 16 projects aimed at sustainable development through digital transformation. Among the key achievements of the office, she named the launch of digital financial services in 2016 and the digitization of the state registry. According to the expert, the main challenges for digitalization in Tajikistan are low quality of internet connection and insufficient coverage, ineffective data management, as well as slow and complex decision-making processes. To overcome the problems, measures were proposed to improve the personnel skills, create a single information portal for project coordination and active cooperation with the government.

International Islamic Trade and Finance Corporation

International Islamic Trade and Finance Corporation

Mohammad Nazeem Noordali, Chief Operating Officer, ITFC, member of IsDB Group, spoke about the multi-country program ‘Trade Connect Central Asia+’ aimed to simplify trade procedures and improve transparency. These measures accelerate economic growth and facilitate the digital transformation of trade in Tajikistan.

Asian Development Bank

Asian Development Bank

Rhodora B. Concepcion, Country Operations Head, Tajikistan Resident Mission, Asian Development Bank (ADB), highlighted three key areas where the bank supports digitalization:

- Structural reforms;

- Human capital development;

- Investing in quality of life.

ADB is also promoting digitalization of agriculture and education, which is an important element of sustainable growth in Tajikistan.

GIZ Tajikistan

GIZ Tajikistan

Andreas Reichel, digitalization specialist at GIZ Tajikistan, noted that the quality of the Internet and the availability of digital services in Tajikistan have improved significantly over the past four years. However, the expert emphasized that digitalization in the country is uneven, and the implementation of some projects is facing difficulties. Cybersecurity remains an important area.

Ibrahim Unal, Head of Turkish Cooperation and Coordination Agency (TİKA), informed about the experience of cooperation between Türkiye and Tajikistan in the field of digitalization.

European Bank for Reconstruction and Development

European Bank for Reconstruction and Development

Holger Wiefel, Head of Tajikistan for the European Bank for Reconstruction and Development (EBRD), emphasized the significance of a comprehensive approach to digitalization. He highlighted the importance of consistent implementation of technologies, as well as the need to engage the private sector to accelerate digital transformation.

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

Experts agreed that digitalization in Tajikistan has great potential, but requires significant efforts to overcome current challenges, such as coordination between government agencies, the private sector and international partners, improving the skills of specialists and digital literacy of the population, as well as the need for investments in infrastructure.

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

With the right strategy and partner support, digital transformation will become the driver of socio-economic development of Tajikistan.

The development of regional startup ecosystems in Tajikistan was the topic of the discussion “IT PARK Project. Heading for effective digitalization of Tajikistan. Startups. Strategy and marketing of a successful startup project”.

The session was moderated by Diana Salekhova, Managing Partner, Terricon Valley it-hub, who spoke about the development of regional startup ecosystems.

Pulod Amirbekov, Country Director, Accelerate Prosperity Public Foundation, informed about the development of startups in Central Asia.

The following speakers also took part in the dialogue:

- Naima Normatova, Board Chairperson, Private Sector Development Union of Tajikistan

- Bakhtiyor Kodirov, Director, Vuppay Tajikistan

- Firuzjon Gafarov, Vice-Rector for Strategy Implementation and Development of Innovative Technologies, Technological University of Tajikistan

- Firdavs Khodjimurodov, Founder of Pixel

- Marat Meyrov, Chief Commercial Officer, Biometric.vision

- Masrur Ishanov, Director, Technohub Dushanbe

- Ozodamo Faromuz, Director, Ilmkhona Skills Accelerator

- Rustam Juraev, Head of Strategy and Analytics, IT Park Uzbekistan

Director of IT Park Dushanbe Temur Khisamutdinov informed about key initiatives aimed at supporting IT companies and developing the industry in Tajikistan. He primarily focused on creating an integration ecosystem incorporating market participants, educational projects and government support. The speaker noted that the innovation and transformation issues have been discussed for a long time. According to him, the main goal is to create a single platform that will allow IT companies not to compete, but to collaborate productively, ensuring interaction at all levels.

IT PARK Project. Heading for effective digitalization of Tajikistan. Startups. Strategy and marketing of a successful startup project

IT PARK Project. Heading for effective digitalization of Tajikistan. Startups. Strategy and marketing of a successful startup project

Speaking at the Forum, Temur Khisamutdinov said that IT Park Dushanbe had become an important part of the ecosystem oriented to the IT sector development. He informed that this institution offers its residents tax and customs benefits, as well as legal and financial support. IT Park operates on the model of agency innovation, which allows the resident status to be assigned to eligible IT companies.

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

At the session “e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects” experts discussed the prospects for the development of the industry, focusing on the role of marketplaces, logistics and new technologies.

Isfandiyor Yazdonzoda, Deputy Director, Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan, took the floor at the beginning of the discussion. He highlighted the importance of a favorable environment for e-commerce. According to him, marketplaces have turned into the platform of the future and a driver of economic growth, especially for small and medium businesses.

ЁВАР

ЁВАР

Asadullo Rakhmonov, Director, YOWAR, revealed the secrets of successful retail and highlighted the importance of human resources in shaping its image. He emphasized that retail is an important economic driver, creating thousands of jobs, supporting local economies, implementing innovations and developing socially responsible initiatives. The speaker named high staff turnover, currently ranging within 30-60%, one of the key problems of the industry.

Association of E-Commerce Participants of Tajikistan

Association of E-Commerce Participants of Tajikistan

Nasima Bahramova, Chairperson, the Association of E-Commerce Participants of Tajikistan, emphasized that logistics is the engine of trade. The Law on E-Commerce adopted in 2023 was an important step in regulating this area. However, a number of problems remain:

- limited access to international trade platforms;

- difficulties with customs clearance;

- the presence of shadow carriers.

These barriers must be overcome to increase customer confidence and create a convenient infrastructure.

OBBO

OBBO

Kamoliddin Ulmasov, CEO, OBBO marketplace, spoke about the successful digital transformation in the country. OBBO has brought together over 350 suppliers and made key processes automatic, creating more than 40 jobs. Among the innovations are the one-click purchase function and a country-wide delivery.

SoftClub

SoftClub

Vladimir Anishchenko, Deputy General Director for Science and Innovation, SoftClub, emphasized the importance of implementing legislative and technological tools for the sustainable integration of e-commerce into the economy.

Anton Golovin, Head of Procurement, Technodom, who spoke online, noted that digitalization and process automation provide a competitive advantage, but must be based on specific business goals.

ORIENT FINANCE BANK

ORIENT FINANCE BANK

Sukhrob Kurbonov, Advisor to Supervisory Board, ORIENT FINANCE BANK, gave a presentation under the title “Ecosystem as an important attribute of development of companies and banks,” where he considered specific examples of the importance and significance of eCommerce in the ecosystem.

Eskhata Bank

Eskhata Bank

Amirjon Akhmedov, who represented Eskhata Bank, spoke about the importance of QR payments for e-commerce. They account for a significant portion of non-cash payments. He named the following advantages of this payment method: convenience for customers, easy implementation by businesses, saving time while shopping.

Wyzo

Wyzo

Abror Kholov, Managing Director, Wyzo, highlighted the growing popularity of social commerce. Social media sales are expected to reach $3.3 billion per day by 2025. These platforms allow entrepreneurs to directly interact with customers, reaching a wide audience.

BABILON-M

BABILON-M

At the end of the discussion, Feerooz Zainidini, Head of E commerce, BABILON-M, informed about their experience of creating an ecosystem.

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

One of the most interesting events of the PLUS-Forum was the session“Fintech. Artificial intelligence. Financial services in the digitalization era. Commercialization of science as an integral part of fintech development”.

CyberNet

CyberNet

The session was moderated by Daniyar Omurzakov, Regional Director for Central Asia, CyberNet.

First Credit Bureau of Kazakhstan

First Credit Bureau of Kazakhstan

Ruslan Omarov, CEO, First Credit Bureau of Kazakhstan, spoke about the advantages of remote biometric identification in terms of business security by the example of the interactive FCB BioGuard system, a three-in-one solution. As the speaker noted, a high level of process automation is in place in Kazakhstan, and the integration with public services allows such systems quickly obtain the information necessary for identification.

International Finance Corporation (IFC)

International Finance Corporation (IFC)

Pavel Shust, International regulation and infrastructure consultant, digital financial services, International Finance Corporation (IFC), considered how new infrastructure projects lead to the emergence of effective financial services, with reference to the experience of the European and Asian markets.

In Tajikistan, the company calls on all market participants to actively participate in the building of a common infrastructure in order to independently determine the tariff policy in the future. This is also true in terms of building an open banking infrastructure. In his speech, Pavel Shust raised the most important issues of solving this difficult but promising task.

VisionLabs

VisionLabs

Ilya Romanov, Chief Commercial Officer, VisionLabs, reviewed biometric trends in the country and globally, as well as the prospects for the development of biometric technologies in the financial sector. He noted that any biometric project implies the initial accumulation of a large-scale database of high-quality data. The second key to success is the ability of the database search for one-to-many comparison, i.e. the availability of a high-quality verification algorithm. Against this background, VisionLabs, along with other solutions, offers today a number of products for protection against deepfakes. According to the speaker, almost every bank in Tajikistan has already implemented some kind of its own biometric system. However, he warned, when the transactions start number in millions, the cost of an error increases dramatically, as does the load on the platform, leading to the reduced conversion and, accordingly, the lower profit of the bank.

Top Consulting

Top Consulting

Mirzoibrahim Ibragimov, CEO, Top Consulting, a business transformation consultant, shared the findings of a recent study of the level of banking services digitalization. He noted that the economy of the republic is closely linked to the dynamics of money transfers, and the market sees a high demand for credit products, including cards. The number of issued cards and mobile wallets is growing, while in rural areas the figures such as the number of cards per capita, are very much lagging behind those in urban areas, especially in the capital. At the same time, the largest salary project in Tajikistan is estimated at $ 5 billion.

Meanwhile, QR-ing demonstrates dynamic growth, with QR payments becoming increasingly widespread in the Tajik market.

INTECHCARD

INTECHCARD

Ildar Skrizhalin, CEO, INTECHCARD, raised the topic of developing the customer journey in payments based on customer perceptions. The speaker began with the ever-relevant question of whether payment cards and POS terminals will disappear from the market in the foreseeable future. Having analyzed the available statistics, he came to an objective conclusion: “Cards are here to stay.” This is proved by the increase in the number of POS transactions alongside with the increase in payment transactions in eCommerce, as well as the growth of the POS terminal network itself. As the expert noted, all these trends are also seen in Tajikistan.

Tcell

Tcell

Farrukh Avezov, Business Development Expert, Tcell, shared his experience of using artificial intelligence and big data in the automation of customer service and sales based on the company's AI platform. As a visual example, the speaker demonstrated the PLUS-Forum audience a video recording of a dialogue with the Lola Telesales robot. The latter, having called 16 thousand clients, was able to sell the offered service to 11 clients out of 100, demonstrating a unique conversion rate of 11%..

zypl.ai

zypl.ai

Firuzjon Sodiqov, Chief Operating Officer, zypl.ai, spoke about leading AI development works in fintech, analyzing key technologies and their practical application. He paid special attention to the digitalization of credit scoring through the use of artificial intelligence platforms.

Robert Courtneidge (Robert Courtneidge), an independent consultant, gave an online polemical presentation “UK vs. EU in digital asset regulation: a strategic opportunity”.

Fintech. Artificial intelligence. Financial services in the digitalization era. Commercialization of science as an integral part of fintech development

Fintech. Artificial intelligence. Financial services in the digitalization era. Commercialization of science as an integral part of fintech development

See you at thePLUS-Forums in 2025!

In recent years, the countries of Central Asia have been seen as some of the most promising markets. They are open to international engagement, cooperation and innovation in a variety of areas, including the financial services market and the retail industry. And in this context, Tajikistan deserves special attention. Its infrastructure, banking and national payment systems, fintech and public services sectors have undergone qualitative changes in recent years, turning the republic into a new market in Central Asia, attractive for investment and promising in terms of the development of fintech.

Experts agreed that further digitalization of Tajikistan requires coordinated efforts of the state, business and international partners. The introduction of modern technologies, the development of digital infrastructure and regulation will form the basis for the creation of a modern digital society, where innovation will be the engine of sustainable growth.

Closing the conference, the participants of the dialogue noted that the adoption of new technologies is dynamically transforming the financial landscape globally, and Tajikistan is no exception. The country is seeing a significant increase in interest in digital financial solutions that are gradually changing familiar processes: from payments and lending to investments and financial management. The growing popularity of mobile banking applications, the emergence of BNPL services and the introduction of QR payments show that new technologies are becoming an important part of everyday life. Financial literacy of the population will be of particular attention in Tajikistan in the very near future.

The PLUS-Forum platform has been on the market for 16 years and during this time has rightly earned a reputation as one of the key events in the industry both in Russia and in the CIS! In recent years, the PLUS team has been paying special attention to the markets of not only Russia, but also neighboring countries, and primarily those in Central Asia. To this end, over the past four years, a number of new events focused on these markets have been organized. And they have already managed to announce themselves as the largest and most popular platforms in the region!

See you at the PLUS-Forums!

See you at the PLUS-Forums!

We invite you to join our programme of large-scale international events. Registration and receipt of application forms are already open for Speakers, Sponsors and Partners!

See you at the next PLUS-Forum editions in 2025!

We offer you media reports of the Forum.

In Tajik language:

О предпосылках организации и проведения ПЛАС-Форума читайте материал:

News of Fintech, retail and e-commerce in Central Asia

OJSC “Certification Centers, Public Services and Digital Programs development” and Huawei Technologies Tajikistan LLC

OJSC “Certification Centers, Public Services and Digital Programs development” and Huawei Technologies Tajikistan LLC

Digital Tajikistan opening ceremony

Digital Tajikistan opening ceremony

Digital Tajikistan has already managed to announce itself to be the most visited event

Digital Tajikistan has already managed to announce itself to be the most visited event PLUS Group and OJSC “Certification Centers, Public Services and Digital Programs development”

PLUS Group and OJSC “Certification Centers, Public Services and Digital Programs development” Central Asian Fintech Association и IT park

Central Asian Fintech Association и IT park

HUAWEI

HUAWEI Dushanbe City (DC)

Dushanbe City (DC)

PLUS-Forum Steering Committee Deputy Chairman Konstantin A. Grizov

PLUS-Forum Steering Committee Deputy Chairman Konstantin A. Grizov

Steering Committee Chairman Alexander I. Grizov

Steering Committee Chairman Alexander I. Grizov

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Ministry of Economic Development and Trade of the Republic of Tajikistan

Ministry of Economic Development and Trade of the Republic of Tajikistan Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Customs Service under the Government of the Republic of Tajikistan

Customs Service under the Government of the Republic of Tajikistan

State Committee on Investments and State Property Management of the Republic of Tajikistan

State Committee on Investments and State Property Management of the Republic of Tajikistan

National Bank of Tajikistan

National Bank of Tajikistan

Huawei Middle East and Central Asia

Huawei Middle East and Central Asia

State Unitary Enterprise “Smart City”

State Unitary Enterprise “Smart City”

Ministry of Finance of the Republic of Tajikistan

Ministry of Finance of the Republic of Tajikistan

Ministry of Industry and New Technologies of the Republic of Tajikistan

Ministry of Industry and New Technologies of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Agency for Innovation and Digital Technologies under the President of the Republic of Tajikistan

Natalia Malyarchuk

Natalia Malyarchuk

Zhanna Dyussenbina

Zhanna Dyussenbina

Huawei

Huawei

Zebunniso Fattidinova

Zebunniso Fattidinova

Horst Treiblmaier

Horst Treiblmaier

National Bank of the Republic of Tajikistan

National Bank of the Republic of Tajikistan

Olim Karimov

Olim Karimov

UpCode

UpCode

S1LKPAY

S1LKPAY

eComCharge UAB

eComCharge UAB

ACCION International

ACCION International

Банк Эсхата

Банк Эсхата

Payments business and Technology

Payments business and Technology

TSARKA GROUP

TSARKA GROUP

Pacifica

Pacifica

Compliance Сontrol & Rakasta

Compliance Сontrol & Rakasta

Silmon Mavlonazarov

Silmon Mavlonazarov

Asomudin Atoev

Asomudin Atoev

“Cybersecurity. Cyber threats and information security in the banking sector”

“Cybersecurity. Cyber threats and information security in the banking sector”

Kibriyo Urakova

Kibriyo Urakova

Dehqon Samadov

Dehqon Samadov

Madina Tukulova

Madina Tukulova

Lyudmila Bogushevskaya

Lyudmila Bogushevskaya

Islamic finance and Islamic banking in Central Asian countries. Current state and prospects

Islamic finance and Islamic banking in Central Asian countries. Current state and prospects

Shavkat Kalonov

Shavkat Kalonov

Evgeny Korenkov

Evgeny Korenkov

Rakhimjon Kurbonov

Rakhimjon Kurbonov

Freedom Bank Tajikistan

Freedom Bank Tajikistan

DECO Systems

DECO Systems

Arenadata

Arenadata

IBS PROJECT

IBS PROJECT

MyBPM

MyBPM

IT Service

IT Service

Victor Dostov

Victor Dostov

Alfa-Bank

Alfa-Bank

Sinara Bank

Sinara Bank

“Digital services without borders. Open Banking: present and future. Banking infrastructure and self-service”

“Digital services without borders. Open Banking: present and future. Banking infrastructure and self-service”

International Payment Alliance

International Payment Alliance

Promsvyazbank

Promsvyazbank

Crypto industry. Trends, forecasts. CBDC 2024. Asset tokenization, fintech platforms and smart contracts. Blockchain

Crypto industry. Trends, forecasts. CBDC 2024. Asset tokenization, fintech platforms and smart contracts. Blockchain

Всемирный банк Таджикистан

Всемирный банк Таджикистан

Mavzuna Shozodayeva

Mavzuna Shozodayeva

International Islamic Trade and Finance Corporation

International Islamic Trade and Finance Corporation

Asian Development Bank

Asian Development Bank

GIZ Tajikistan

GIZ Tajikistan

European Bank for Reconstruction and Development

European Bank for Reconstruction and Development

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

The role of development partners in supporting digital transformation: challenges, opportunities and prospects

IT PARK Project. Heading for effective digitalization of Tajikistan. Startups. Strategy and marketing of a successful startup project

IT PARK Project. Heading for effective digitalization of Tajikistan. Startups. Strategy and marketing of a successful startup project

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

ЁВАР

ЁВАР

Association of E-Commerce Participants of Tajikistan

Association of E-Commerce Participants of Tajikistan

OBBO

OBBO

SoftClub

SoftClub

ORIENT FINANCE BANK

ORIENT FINANCE BANK

Eskhata Bank

Eskhata Bank

Wyzo

Wyzo

BABILON-M

BABILON-M

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

e-Commerce is taking off. Marketplaces as an evolutionary trajectory. Business strategy. Prospects

CyberNet

CyberNet

First Credit Bureau of Kazakhstan

First Credit Bureau of Kazakhstan

International Finance Corporation (IFC)

International Finance Corporation (IFC)

VisionLabs

VisionLabs

Top Consulting

Top Consulting

INTECHCARD

INTECHCARD

Tcell

Tcell

zypl.ai

zypl.ai

Fintech. Artificial intelligence. Financial services in the digitalization era. Commercialization of science as an integral part of fintech development

Fintech. Artificial intelligence. Financial services in the digitalization era. Commercialization of science as an integral part of fintech development

See you at the PLUS-Forums!

See you at the PLUS-Forums!